All Forum Posts by: Travis Biziorek

Travis Biziorek has started 7 posts and replied 1764 times.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Josephine Wilson:

Hey, @Travis Biziorek, sorry took a break from BP for a while, no doubt partly to observe the political thriller unfolding in DC. At any rate, yeah, I see what you are saying. But isn't landlording just a hassle for retirees, or they pay for property management that eats into the income? Maybe the numbers still work out better than passive investments.

You're grasping at straws here, IMO, Josephine. Maybe the numbers still work out better than passive investments? You mean, the worse than inflation returns that bonds present?

Property managers generally take ~15%. So calculate any rate of return you'd get... 4%, 8%, 10%, whatever and take 90% of that and compare it to the rate of return in a savings account, treasury bond, etc. It still blows it out of the water.

Post: First Time Buyer in Detroit

Post: First Time Buyer in Detroit

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Paul S.:

Originally posted by @Travis Biziorek:

Originally posted by @Paul S.:

are you local? Budget?

No. $5,000. Can you plz help?

I have the perfect property for you Travis! I just need you to bring $5,000 and 5000 bricks...

Sounds legit. See you soon!

Also, I think it may be more than 5,000 bricks...

Post: First Time Buyer in Detroit

Post: First Time Buyer in Detroit

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Paul S.:

are you local? Budget?

No. $5,000. Can you plz help?

Post: Detroit Property Manager or Landlord w/House Hack

Post: Detroit Property Manager or Landlord w/House Hack

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Brandon Johnson:

Hey BP Family,

Wanted to know if you all could share your opinions and thoughts on being a landlord vs hiring a management company. My main concern is trusting them to screen the tenants and choosing them since I’ll be living above them in a duplex.

Do you all know if I have the opportunity to let them know what requirements I want to set for rental qualifications?

Also is there a management company near the Detroit area you would recommend from experience?

Any and all comments/feedback is helpful.

Thanks,

If you're out of state and investing in a duplex... I get the need for a property manager.

But you're talking about house hacking. Why WOULDN'T you want to manage it yourself?! The only excuse would be you're lazy or really don't want to get into RE because you're afraid to get your hands dirty.

Managing your own properties, like Paul said, is always better than someone else. Nobody will choose a tenant like you will, nobody will care for your home like you will, etc. etc. If you're scared to be a landlord and gain all the valuable knowledge that comes along with that, this business likely isn't for you.

Post: show me a multi-family meeting 2% rule

Post: show me a multi-family meeting 2% rule

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

I purchased an off-market duplex last year in Detroit. I blogged about it a few days ago. Purchase price was $64k including the wholesaler's fee. The bottom unit was fully renovated and had been owner occupied. We put ~$6k into the upper unit, so we're into it for about $70k total.

The bottom is rented at $800/mo and top is $850/mo. We'll likely push the bottom unit up to $850 when the lease comes due in June. So $1,650/mo total right now on $70k invested is 2.35%

The building is in a C-class neighborhood. My tenants are great and make $50k-$60k respectively. They pay early or on-time, and I never have to hassle them for rent or water reimbursement.

Admittedly, even just a year later, it's hard to find deals like this. Values have been going up in the area and now you've got people trying to get $50k for full rehab duplexes on the same street.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Josephine Wilson:

@Travis Biziorek Thank you for being super tactful in pointing that out. So it seems like RE is a better deal than that comparison suggests.

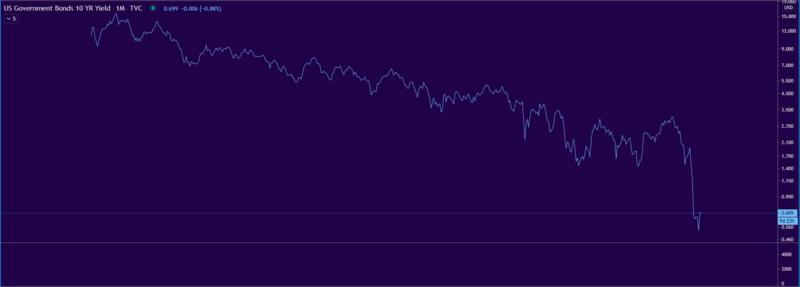

Absolutely, by a mile. I'm not sure if you took my reference to the "10 year T-bond" and thought I was referencing a fund. What I was actually referencing is the trend on interest rates of the US Treasury 10-year bond.

Below is a chart of that instrument going back to 1980. That's 40-years of declining interest rates.

Back in the 1980's you could invest in bonds and receive interest payments in the low double digits (12-13%). In the 1990's you could get high single digit interest payments. By the late 90's... mid single digits. By 2005-2010 you'd be looking at low single digits. From 2010 and on it's been between 1.5-2.5% until recently where we sit at just 0.70%.

The 10-year interest rate is the best barometer for for mortgage rates (add in a bank's margin). Now tell me why you'd ever bet on rates going higher? It's also almost impossible to find a 5-7 year period (standard ARM length terms) where you'd be in trouble when you're ARM came to maturity, let alone screwed like so many people believe. Never mind there are plenty of other reasons why ARMs aren't at all toxic.

I drifted. My point is, again, there just isn't an easy place to find yield anymore, so retirees need to move into real estate to live comfortably. Sure, a 30-year treasury bond pays a WHOPPING 1.45% right now which is about double a 10-year, but that's still below average inflation. So why not pay cash for the deal that "makes absolutely no sense" at a 4.6% cap rate, make a comparatively killer yield compared to what they could get elsewhere, know that the apartment will likely appreciate AND they'll be able to raise rents at a clip better than inflation. That 4.6% yield today may be 5% in a year, 5.5% in two years, and maybe 10% in 20 years.

What do you think the yield on bonds will be in 20 years given what you know now?

Yeah... makes a lot more sense now, huh? ;-)

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Josephine Wilson:

@Travis Biziorek Wow, BP saved the best for last here with this response. Yeah, I get what you are saying. The average yield for Vanguard Total Bond Market over the past 10 years is about 3.8%, so the yield here is better, and that's without factoring in potential appreciation in rents or home value. So if you are looking for somewhat better yield, security, diversification, and maybe an inflation hedge, it makes a lot of sense.

Right, I’d also be careful looking at blended return for a bond fund. Bond prices are inversely correlated to yield.

So even though the fund’s return is going up, it’s been largely due to bond prices rising over the years.

Most retirees want to avoid selling assets to fund their retirement, hence the importance for yield.

All I’m really saying is to make an apples to apples comparison you’d need compare that 10-year bond fund return to a blended real estate return that includes appreciation on the RE, not just cash flow.

Post: Building Property in Detroit

Post: Building Property in Detroit

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

@Durrel Douglas nice, man. Welcome!

Let’s connect sometime. I started a bit over a year ago and have 9 properties now. If you’re willing to put in the work, I don’t think there’s a better opportunity.

Post: Building Property in Detroit

Post: Building Property in Detroit

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Anything you would buy through the land bank would require EXTENSIVE rehab. And most stuff worth owning from the land bank is long gone.

I would not recommend taking this approach as an OOS investor, or even locally (for most).

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Investor

- Arroyo Grande, CA

- Posts 1,837

- Votes 1,958

Originally posted by @Josephine Wilson:

Newbie question here: I'm looking to buy a Class A triplex or quad within 10 minutes of my house and doing property management and maintenance myself. I live close to a large university. Of the 20 recently-sold small multis I've analyzed, nearly all have little to no cash flow and cap rates averaging 4.6%. (2048/2050 E 6th St, Tucson, AZ 85719 is one example.) Some even have substantial negative cash flow. Everything I'm reading says these cap rates are not favorable. So why are people buying these properties?

I'm thinking the buyers are A) hoping for appreciation and don't mind no cash flow, B) planning to increase NOI or hoping that market rents will rise, C) wealthy parents buying a place for Johnny/Susie to live for four years or D) house hacking. Can folks offer their insights into why buy properties with negative cash flow and low cap rates?

For anyone interested, here are my estimates for my example property: 2048/2050 E 6th St, 85719

Price: $245,500, two 1BR units, 1219 sq ft total

Rent: $1454

Maintenance: $205

P&I: $938

Taxes: $195

Cash flow: -$39

Cash on cash: -0.7%

Cap rate: 4.4%

Maybe I should have read every single reply before mine, but I read the first page and it didn't seem like anyone was going to hit on this.

Everyone will tell you people don't "know what they're doing" are "overpaying" or are stupid because "a crash is coming!!!!". Even the reasons you listed, while potentially true to an extent, completely miss the macro picture. And until you recognize that, you'll fall in the camp of thinking that nobody knows what they're doing, except you (speaking generally here) who sits on the sidelines waiting for a crash that will NEVER happen.

Yup, I said never.

Here's the thing... interest rates are at record lows and are NOT going back up. Period. The Fed just came out last week and said they'd be "at or near zero until at least 2023". Spoiler: they aren't going up even after that. And I could go into a very long, boring economic lecture about the current state of monetary policy and economics to explain why. But it's easier to just look at a multi-decade chart of the 10-year T-bond and say, "yeah, there's zero reason to fight that trend". It's the same reason I will ALWAYS get an ARM for my primary.

Anyway, so rates are extremely low and, if anything, will go lower (yes they can go negative... just look outside the US). And we've got a bunch of baby boomers entering retirement. What happens when you enter retirement? You need income. You need that stash of cash to work for you so you can live comfortably with little risk.

In the past, that was easy. Buy bonds, CDs, or your trusty savings account for a decent yield. That yield is gone from everywhere. They don't want to hold stocks for two reasons, 1) many folks believe they're overvalued (rightfully or not) and 2) when you're retirement age it's not feasible to ride out a multi-year decline in stocks (aka it's too risky to have your retirement money there).

OK, so we understand there's a massive number of folks that NEED yield (not just want like so many here on BP) and there are increasingly fewer places to get it. Go tell them they can get a 4.6% return on their money on a hard asset that will likely continue to appreciate in value.

Where else can they get that? I'll wait...

Yep, pretty much nowhere. So they're buying up real estate to park their money and live out their golden years. Can you blame them? Isn't that what we're all trying to do?

The only difference is we're all trying to get to retirement while they're already there. So they don't need the yield that we feel we need.

The bottom line is real estate investing is becoming increasingly popular. Margins are getting squeezed from that direction and from those that are NEEDING yield for retirement. So we have to accept lower ROI or find a market that's less desirable.