Dave Ramsey Is Misleading The Public

I wanted to address this to educate people who have been mislead by the financial services industry...not just Dave Ramsey

Step 7 - Build wealth and give. This is where he want's you to "invest in mutual funds," and to be fair real estate (all cash and 5% of your investments). So let's assume the other 90-95% goes into mutual funds. Just go to his website and it's obvious he's drank the mutual fund koolaid. Again, not sure whether he knows how bad his advice is and is lying or is completely ignorant. My guess is it's the former because of the mental gymnastics required for articles like this from his blog.

And if you read the blog post it becomes obvious why I tend to believe he's blatantly lying to his audience and his whole schtick is a rouse. see below

Notice he brushes off the lost decade by saying you have to look at the bigger picture and you can't cherry pick time frames. But that's exactly what he does to make his claim about the 12% average returns. The whole basis for for the blog post and a big part of what he sells to his audience.

But it goes from a subtle white lie to blatant fraud when you look at how he's selling a "12%" return.

Meaning, most of his listeners are unsophisticated, they don't know a 12% drop one year and a 12% gain the next doesn't put you back at zero. They think that their money will just compound at a 12% clip annually. Let's look at reality.

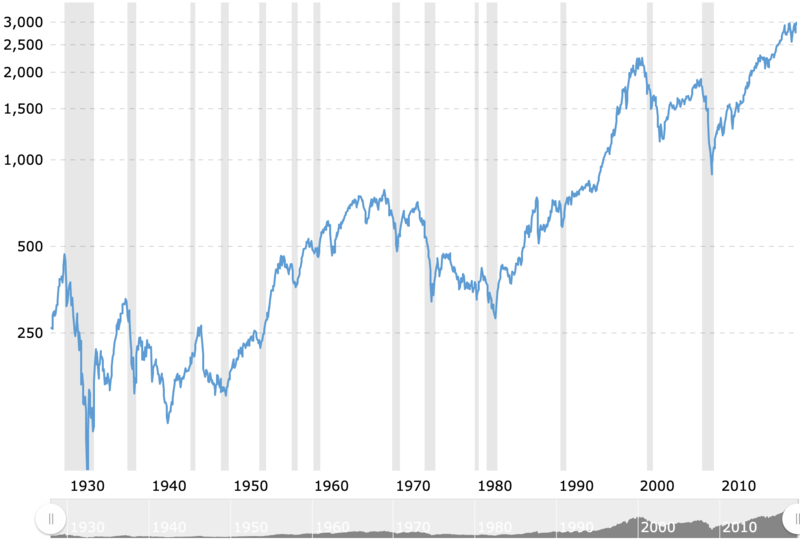

If we took what DR says at face value, the market goes up on average of 12% a year going back to 1923, we should be able to type the value of the 1923 S&P into a compound interest calculator, input 12%, and we should have roughly 3000 (where the S&P is today). I only have data from 1928 on, but I think you'll still get my point. The S&P was 17 in 1928. Let's see what happens...

If what DR says is true, the way he sells it to his audience, if S&P would have to be at 512,000 right now!!! It's at 3000!!!

And I'm not even adjusting for inflation. Adjusted for inflation (meaning 12% annual increases in purchasing power) the S&P would be at over 7,500,000!!! YES, 7.5 MILLION.

You maybe saying to yourself, "what George is saying can't be true" DR would never get away with that much of a lie. Here's why DR can get away with his claims. They're true in literal terms but they're wildly false in the way he presents it to his audience and how his audience perceives what he's saying.

DR presents this 12% claim as though, over the long haul, your money will grow by 12% a year. FALSE! Why? Because when a number is reduced by 10% and then increased by 10% you're not left with the same number...it's lower.

As an example. Take $1000 and decrease it by 50%, you now have $500. Increase that $500 the next year by 60% and you now have a total of $800. A $200 (20%) loss but a 5% average return (-50 + 60 = 10/2 = 5%).

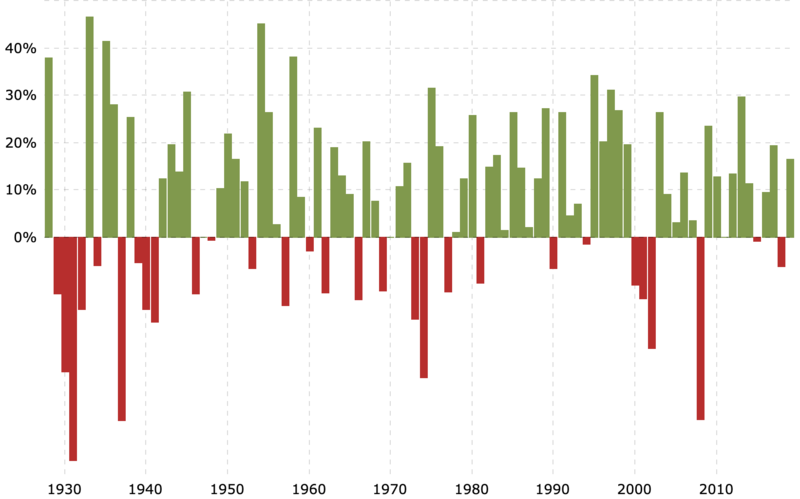

This becomes very clear when we look at graph of annual S&P returns.

Or better yet, look at an inflation adjusted chart. Please notice how much you'd make if you invested in 1928 and left your money in for 52 years, until 1980.

You would've made zero (adjusted for inflation). Dave Ramsey what happened to 12% per year??

What infuriates me the most is he targets people in the south and people who go to church, in other words people with traditional values who are more susceptible to his "be prudent, save money, no debt, invest in mutual fund" snake oil.

To be clear, 10% of what he says is spot on, have a rainy day fund and don't take on consumer debt, but the other 90% is so bad it's completely inexcusable.

If you're one of the millions of Americans, not just DR fans, who have drank the koolaid of the financial services industry and invested into the "safety" of mutual funds, I apologize, I don't relish being the bearer of bad news. But as I said in my first post on this thread, I feel a moral obligation to set the record straight.

Please note: I didn't even hit the tip of the iceberg of why mutual funds are quite possibly the worst investments on a risk/reward basis. I understand I exclusively focused on S&P and mutual funds typically contain bonds. I did this because interest rates have been driven down so low by the Fed, mutual funds no have to overweight equities because they can't get a return from bonds. This problem will be exacerbated if/when US bonds go into a negative yield like Europe and Japan.

I realize this is complex stuff. It's why DR can dupe so many, including maybe himself. I'd like to point out I learned none of the above in college. ;)

If you have any questions don't hesitate to reach out, all my contact info is on my profile.

Good luck,

What we need to realize is that most 99.5% (my keester number) will are owned by there 20 dollar alarm clock. They always will be. With that being said, I see no harm In that very large group of the population taking instruction from there radio during there commute. Dave Ramsey or Rap Music, you decide. I like the idea of them saving a few coins to pay there own way. Put down the Red Bull and drop 3 more bucks into your 401K that your master will match. If you make 8% return and adjust for inflation, you have a gain of 1%. 1% gain is better than smoking a cigarette containing plutonium.

9 to 5 till 65 (while saving) might get you an extra year in a care home before you run out of funds and Medicaid kicks in. I know this sounds futile, but it is a break on other tax payers who will be finding Medicaid and these other programs.

Shawn Coverdell

Homes in the Hood

If it wasn’t for Dave Ramsey I would’ve not been able to invest in Real Estate already.

It’s not about agreeing with everything but taking what’s useful and applying it.

@George Gammon I think that owning RE is a wayyy better investment than stocks. Shelter has always been here before us and it will be here after us, those companies in the stock market will not last forever, which investing in the stock market is speculative anyways, RE is the way to go.

@George Gammon

Dave Ramsey and his program about getting a budget, living within your means and paying off consumer debt was huge! Only good stuff to say about Dave Ramsey.

Taking anyone too literally for your own financial situation is likely foolish.

I’m glad I learned tools to manage money effectively and love financial acumen and real estate investing, even leveraging to own assets is a not written part of Dave Ramsey’s program...really depends on your goals and capabilities. Majority of Americans would be way better off if they simply got out of consumer debt, that’s why Dave Ramsey and his ministry to better the world is never to be judged or diminished.

Wrong!!! "The majority of Americans would be better if they had the brains to avoid getting into debt".

I fully understand when a person gets into debt because something happens to their job, or they come up with a debilitating health issue, but most debt overload is do to ignorance and being materialistic where people are willing to pay double for things they can live without and they are even willing to pay another 50% to 100% for the interest to borrow the money so they won't have to wait until they can pay cash.

Not Me! You are talking about those other people! I love the idea of living in a cardboard, stress-free, on the side of a freeway ramp. But before I go live there I want to take my laptop, cell phone (can't live without Facebook) my 6-foot flat screen TV, $4,000 Comfy bed and my 3 dogs (they only cost me about $300 per month, or $3,600 per year). I had three big dogs and their food was about $240 per month. It cost me another couple thousand dollars every year to clean their teeth, put teeth and for every other illness imaginable.

I hope everyone has seen the movie 'The Jerk'. If you did, did you ever wonder why they named it 'The Jerk' since one of the premises of the movie is about managing money and being materialistic.

This is a very interesting post. A couple thoughts; Dave Ramsey gets his 12% return by investing in mutual funds that out perform the S & P 500, not investing in the S & P directly. Secondly, Dave Ramsey states he owns a lot more real estate that he does mutual funds. Lastly, he states on the show that his plan is a great way to get your "net worth to $1mm-$5mm not $50mm-$100mm". That goes to show that his financial plan is a great way for people with little financial IQ to achieve "financial peace".

-

Real Estate Agent Florida (#SL3473500)

- Global Investors Podcast

- https://harborsidepartners.com/commercial-real-estate-podcast/

In 2008 my wife and I took the Financial Peace University course. It was life changing. The initial post description of Dave Ramsey is biased at best. Clearly Dave Ramsey says spend your money on whatever you want. He invests his in real estate...a lot of real estate. And, so do I. Frankly there are many plans out there including Rich Dad, Poor Dad and Millionaire Mind. Both of those are very good too. It is not about which is right or wrong, but which is best for you. Ramsey has helped millions (let that sink in) of people to gain financial freedom. Let's not bash, but learn and find a path right for each of us. Good luck everyone.