All Forum Posts by: James H.

James H. has started 18 posts and replied 47 times.

Post: Funding a home purchase with no W2

Post: Funding a home purchase with no W2

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

Pretend you lost your job..

What if any loans are available for an individual with 20% of his purchase price+closings and reserve funds but no W2 income. Pretend you have been a real estate agent for under 2 years so showing two years of tax returns are not an option.

Would the right bank consider issuing a morgtage based on a newer part time job 30 hours+self employed income?

Thanks for your thoughts.

Post: Am I supposed to be in Love??

Post: Am I supposed to be in Love??

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

Hello everyone,

As I sit here reading a stack of REI books and real estate salesmanship books I realized how often I read lines in my books like this, *please note I'm paraphrasing these may not be exact quotes “I do this because I love it” and “If you’re not passionate it, it will end up feeling like a job” “I have to try and not talk about it with my wife” “It’s the last thing I’m thinking about when I fall asleep” ”REI is my favorite hobby” and so forth..Wow I think to myself, that’s some passion!!

I looked out the window, feeling a bit tired from my 2 hour reading streak and I noticed the beautiful blue sky and asked myself this question...

Do I Love this enough to do this? In the logical part of my brain I understand and very much desire to develop passive income and I know that REI is likely the best way on earth to do this. But I don’t think I love it the way that these authors appear to..

I don't seem to love it the way many people I speak to at REI clubs do. I am very much committed to financial security and eventual independence but I don't know that I will ever get nearly as excited as some people do about it. At the end of the day, it's a business right? That's where I'm coming from. Do I have to Love it?

Do you reader of this post..Do you Love Real estate investing?? Is it your hobby? Your baby? Are you as obsessed with it as the majority of my books, podcasts and articles seem to indicate you should be? Does your wife/husband beg you to talk about anything else?

Should you, me or anyone reading this start down the road of real estate investing (With an iron Will to see it through, even though it will only ever be a source of income and a necessary, although not particularly enjoyed venture?)

As for me, I'm extremely motivated to develop passive income and I will finish 100% of what I start. That's just who I am. I don't take the REI endeavor lightly and I'm on my 7th book on the topic.

Tell me friend, do you just love it so much? Is it your baby? Would you still engage in the REI venture if you loved it a lot less? Would you engage in REI exclusively on the grounds that it makes wonderful money (when properly ran and treated like a serious business and not a hobby)

I don’t look forward to comments like “If you don’t really enjoy it you won’t be good at it and you will loose tons of money” *cough umm.. I know that’s what everyone says. I’m wondering how many of you do this more as a business and not because you can’t go to bed without talking about it with your wife/husband.

Tell me...

Your though will help me and other readers gauge how “In Love” we should be..

I value each of your opinions like Gold thank you for reading.

Your friend

James

Post: [Calc Review] Help me analyze this deal

Post: [Calc Review] Help me analyze this deal

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

Hi Tim thank you for checking that out for me. So I didn’t have a vacancy rate because both units are rented and also because I’m brand new to this and didn’t realize I needed a number for vacancy. I looked up on the US Census website what the average rental vacancy rate in my state is. It hovers around 6-7% as of 2019 so I changed my vacancy rate to 7% I upped my CapX from 7% to 10% like you mentioned.

No this would be a conventional loan non owner occupied non FHA. This property is actually under contract now but I'm still using it to practice running numbers on.

Tim, the full description of the listing says that the tenants split the utilities and they have separate meters. Does that mean that they split all expenses like Water, sewer?

Full description below

“Fully Occupied 2 Family in the heart of Middletown. Located right off Main St and around the corner from Harbor park. Unit #1 contains 2 bedrooms, 1 bath with monthly income of $850. Unit #2 includes 3 bedrooms, 1 bath with monthly income of $1050. All utilities are split within units/owners meters. Property also includes a two car garage with workspace/bench with an additional oil furnace bringing the opportunity for additional rental space. Don't miss this investment opportunity!”

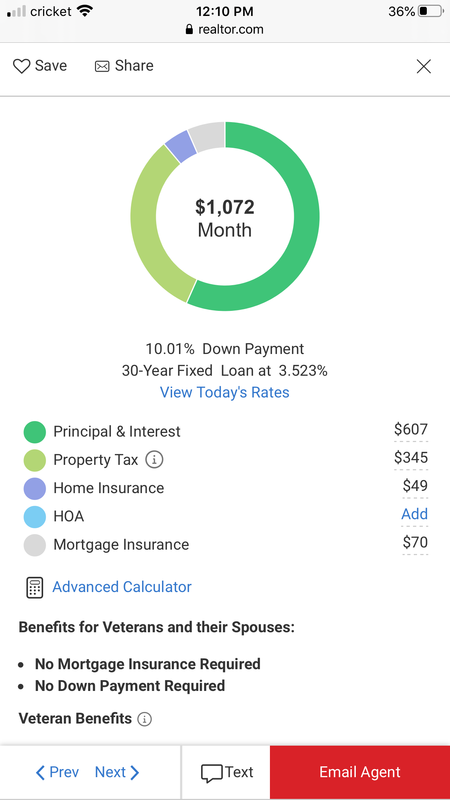

Also with the image below, how accurate have you found numbers like these estimated numbers to be? Thank you for looking this over!

Post: [Calc Review] Help me analyze this deal

Post: [Calc Review] Help me analyze this deal

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

*This link comes directly from our calculators, based on information input by the member who posted.

Post: Best way to discover current property taxes on web listing?

Post: Best way to discover current property taxes on web listing?

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

Thank you guys, I just looked online and sure enough I can get it on the town websites. Boy does that save time or what?

Only talking about property taxes now, will either of you guys put an offer on a house using only the property tax information provided by the websites? Realtor.com Zillow, Trulia? Or will you always look it up on the assessors websites to confirm?

Post: Best way to discover current property taxes on web listing?

Post: Best way to discover current property taxes on web listing?

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

Hey everyone thanks for taking a second to read this post it means a lot to me thank you.

Short of actually going to the town hall and pulling the information by hand, is there a faster way to get accurate property tax information on any given property?

Thank you!

James

Post: Need creative finance advice

Post: Need creative finance advice

- Real Estate Agent

- Connecticut

- Posts 48

- Votes 6

I would get your property appraised and do a refinance, pull out your equity and get out of trouble. Pay off everything with the money from the refi. Also don’t pay for expensive credit repair services. Credit scores are not hard to repair. Buy Carolyn Warrens books on credit repair on Amzazon. They are super cheap, quick to read. I brought my score from low 600s to a 777 FICO today less than 1 year using her simple strategy. I hope this helps