All Forum Posts by: Joseph Firmin

Joseph Firmin has started 22 posts and replied 942 times.

Post: Passive RE investment diversification

Post: Passive RE investment diversification

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Hi @Ashish Rizal, always good to diversify your holdings in different asset classes and investments. To vet sponsors, look at their partners and track record. With syndication it comes down to you trusting the sponsor team and understanding the individual opportunity itself, mitigating risk where you can and ensure you are asking the right questions of the sponsor team. Make sure to take a look at things like whether the business plan has multiple exit strategies, whether there are signs of conservative underwriting, and double-check whether the proposed business plan makes sense given the asset class, submarket, and current economic cycle. Research market trends in job and population growth. Review minimum investment requirements, projected hold time, and projected returns. Finally, attend the investor webinar and ask tough questions.

Post: Starting out as a premed college student in real estate

Post: Starting out as a premed college student in real estate

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

If you're more interested in real estate than a medical career then go into real estate. If you would love to go become a doctor and that is your passion - do it, you can always invest in real estate passively or actively in the future. While not mutually exclusive options, the career piece comes down to what you'd love to do and the lifestyle you want combined with the gifts and talents you have which will make you fulfilled. Real estate investing can be done as a career or as something on the side, so this is your call.

Post: Aging Parents: Multigenerational Home or Get'em A Small Ranch?

Post: Aging Parents: Multigenerational Home or Get'em A Small Ranch?

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Hi @April L.! You asked for opinions here, so at the end of the day it is really a gut call on your part as both have merits. From your post, it sounds like you'd rather have the basement/attached dwelling unit option. As a parent and investor, I can understand it completely and that' the option I'd choose for life-simplicity and peace. The liabilities will still be there in a basement and additional appliances, etc., but being under the same roof and property minimizes other expenses like taxes, overall maintenance and... babysitters. :) There are ways to minimize the mortgage payment if that is a major hangup of yours. I'd consider looking into a 1st lien position HELOC instead of a traditional mortgage. I'd be happy to explain more, but it is a great strategy if you have equity and positive cash flow each month. Check out Replace Your Mortgage. Happy to help!

Post: First rental property

Post: First rental property

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Congrats @Jermaine Jamison-Boston, you're in the right place! Check out Cozy.co. It is a great & free resource for screening, property management, etc. Also check out Stessa for your accounting. Do yourself a favor as a new landlord and read Landlording on Autopilot by Mike Butler or The Book on Managing Rental Properties by Brandon Turner, these should help tremendously.

Post: compenstaion for termites in rental

Post: compenstaion for termites in rental

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Check your lease and local law, but in the end - do the right thing. This is your call. If you want to play it by the law and the lease, that's fine and within your rights, just explain that to the resident. If you want them to stay long-term and you think they may - perhaps be more flexible.

Post: Lending when maxed your D2I

Post: Lending when maxed your D2I

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Hi @Brett Danehey, there are credit unions and even online lenders like LimaOne that will lend to LLCs. This should fix your problem. The interest rate problem though is another... if 5.5% won't work then your numbers must be very tight. Another way would be to seller finance all or a portion of a deal. Or just invest in a more cash-flow friendly market. As you reach out to lenders, reiterate your experience, the properties you have and how they're performing. When lending to an LLC, they will still look at your personal financial statement to see if your balance sheet will support the new loan since it is recourse debt (unless of course you get agency debt - non-recourse).

Post: Help finding a lender

Post: Help finding a lender

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Most lenders I'm aware of require 2 years like you mentioned. Perhaps push for a seller financed offer that way you avoid the bank and then have 2 years to build a history.

Post: Help finding a lender

Post: Help finding a lender

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Sorry to hear that @Dane Silchenstedt. Perhaps you can reach out to Dave's team and ask them to recommend a lender since you can't find one. The best returns in real estate are when you use debt - not overleveraged - but smart debt structures. Dave lost it all by being overleveraged and not having cash reserves, thus his teachings assume everyone else will do the same if they use debt with REI. Love the financial security teachings and getting to a free position, but being smart and disciplined with debt is a must with REI.

Post: UK Expat living in GA!

Post: UK Expat living in GA!

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

Hi @Account Closed! Good for you getting started early man. I'd start to build my network in the UK, so you can hit the ground running and sourcing deals once you return. If you do want to continue to invest in the US, set up an LLC here and you can invest through that as a foreign investor. It isn't hard to set up and you'll need a US bank account, but then you can be positioned to invest in the US. I'm unfamiliar with the UK market, but I'd assume most principles still apply. You can fast track that understanding by networking and asking you current network to connect you to persons in the UK who may be familiar with investment properties. Ask WHO not WHAT and you can move faster.

Post: What to give R.E. appraisers on appraisal day?

Post: What to give R.E. appraisers on appraisal day?

- Rental Property Investor

- Smyrna, GA

- Posts 974

- Votes 645

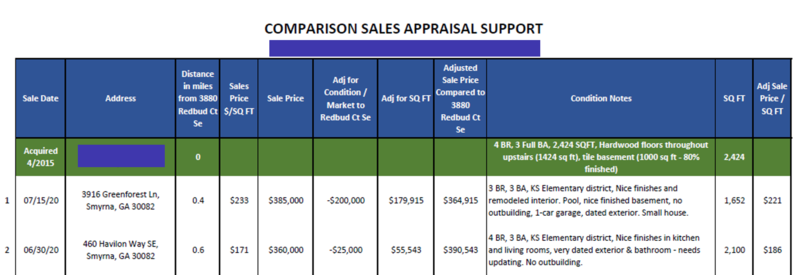

Hi @Jared Johnson, I always provide 2 documents: 1) a Comp Analysis that shows $/sq ft and links to recently sold properties in the area and specifies comparative finishes. (See picture example included here) 2) A list of all the upgrades/changes to the property I've made and the associated costs and dates made. These two have helped me get the appraisals back that support the valuation I believed for the property.