All Forum Posts by: Nick Gerli

Nick Gerli has started 17 posts and replied 66 times.

Post: Markets with Most Appreciation

Post: Markets with Most Appreciation

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Ryan Kelly:

@Nick Gerli You don't see any Texas cities on this list because we are a non-disclosure state and they don't have the data. However, Texas is exploding and Austin's median price in November was up 19.8% over November 2019, matching the highest city on this chart. We've got the lowest inventory in our history and demand is through the roof.

Thank you for the comment, Ryan!

Zillow does have Texas on this list - it's just that their appreciation is much lower. The Austin metro areas comes in around +8.5% year over year.

I don't think being non-disclosure lower the valuations much. Zillow knows what all the list prices are as well as if there are price cuts/increases, which allows them to triangulate appreciation even without hard sale data.

Post: Markets with Most Appreciation

Post: Markets with Most Appreciation

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Shannon Robnett:

@Neil Narayan I don't know if that is totally accurate as Idaho is also a non disclosure state. Remember these are probably by % so in the case of Boise, with a population of of 228,000 people another 25,000 people would really stick out but Austin would have to move in over 90,000 new residents to have the same growth rate....That's the funny thing about stats!

You bring up a good point, Shannon. Boise's growth has been very strong. Just to clarify the numbers:

The Boise metro area, which has a population of 750k, has averaged +20k people per year since 2015. That's an annual growth rate in the +2.5% range - one of the highest in the country.

The Austin metro area, which has a population of 2.2 million, has averaged +55k people per year since 2015. Also about a +2.5% increase per year.

Source: US Census Bureau

Post: Markets with Most Appreciation

Post: Markets with Most Appreciation

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Neil Narayan:

I am guessing none of the Texas cities is on the list since Zillow does not have sold data for Texas as it is a non-disclosure state

Thanks for the comment Neil!

Texas is a surprisingly poor performer according to Zillow. All its major cities are below the US average of +8.5% YoY, with Austin and El Paso tracking as the best and San Antonio as the worst.

Texas builds more new homes than anyone else, so this could be causing the softness.

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Michael Wilson:

@Nick Gerli I would argue with current economic climate, the A or B areas are undervalued. There is a high amount of population leaving California due to outrageous taxes, strict mandates regarding stay at home orders, and cost of living. It also helps that many companies allow employees to work from home. In Maricopa county, most homes are less than half the price for comparable homes in most parts of California.

That's an interesting point regarding locational differences Michael!

What I find in the data is that, in most markets, the Class A areas tend to underperform everywhere else. This is likely because they're so pricey that not many people can afford to move-in.

However, if a lot of the inward migration is a certain higher-income demand segment, then maybe the trend could change course in coming years.

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Mick Hofmann:

It certainly is a crazy market right now, but since the housing crisis there has been a lot more regulation on the lending side as mentioned above. A lot of businesses have moved here which has created more jobs, and so more people. And now with Covid and work from home being the new norm, we are seeing a large inflow of people coming from all over because it is affordable and the weather is nice. Interest rates have also added to the large buyer demand. Although appreciation has been through the roof, people are more concerned about their monthly payment than the price tag.

Having said that, most of what I have read and heard is that 2021 will be another strong year for sellers with such large buyer demand, low inventory, and interest rates will continue to be at historic lows. However, all the stimulus packages will come with a cost and I think we will see inflation moving on past 2021, but what is the best hedge against inflation? Assets that have been locked into a low interest rates. So if you are wanting to buy, get busy, because the best time to buy was yesterday.

Mick - thank you for the response!

You bring up a great point about inflation. Between low interest rates and the prospect of an economic re-opening demand surge sometime this year, inflation could finally rear its ugly head.

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Ingryd Hernandez:

@Nick Gerli as we learned in the recession, you can't go wrong in the areas closest to metro Phoenix so long as it's Class A and B areas. What helped build the 60% decline in home prices were the outskirt properties where the communities were more Class C or less communities. That's the real talk because those were the communities of people who were most taken advantage of (includes this Latina - I ended up short selling).

I think prices are where they should be from a demand perspective in the non-outskirts areas. Phoenix and surrounding cities have a lot to offer economically and people can live here and even work remotely without needing insane amounts of salaries. That's my 2 cents.

Thank you for the response Ingryd!

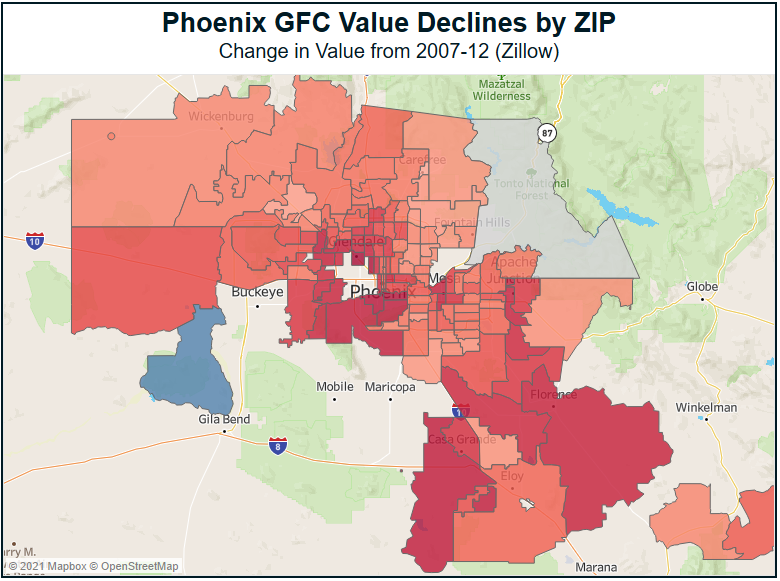

Below is a map using data from Zillow to highlight the ZIP codes with the most value loss from 2007-12 (redder = worse). I believe it confirms what you're saying.

The areas to the Southeast (Florence, Casa Grande) got hit very hard (-60%). Glendale/Peoria and Tolleson/South Mountain were also badly impacted.

Scottsdale seemed to to be the least impacted (-30%).

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Account Closed:

I’m not sure it’s conveying the full picture when saying the values have increased 114% in the past 10 years because that’s going back to the cratered values of the recession (down 60% from 2007-2012). So if the values came down 60% and from there went up 114%...there has been appreciation but no where near the 114% if that makes sense.

Having invested since 2005, one of the main differences between now and back then is financing. Stated income and banks pushing loans back then had everyone buying homes they knew they couldn’t afford. Many thought they could just sell in 6 months and make a quick 15%.

Today has many more checks and balances before being able to qualify for a home/investment property.

I could go on, but I think with good weather/no natural disasters, cheap but more stringent financing, a hot job market, and seeing a number of Californians moving here (along with other out of state buyers), we won’t see anything similar to 2007-12 maybe only a slight decline or flat appreciation if there is a national dip.

Joe - thank you for this thoughtful response!

I agree that using 2010 as the starting point is a bit deceiving with Phoenix. It's average value today is actually still lower than it was back in 2006!

That's great perspective on the financing side of the equation. Good to see that the market is much healthier in that respect!

Post: Markets with Most Appreciation

Post: Markets with Most Appreciation

- Investor

- Austin, TX

- Posts 72

- Votes 77

Below are the markets with the most value appreciation over the last 12 months. Data is sourced from Zillow and covers the "metro area" for each market.

Some Observations:

-Boise is in another stratosphere. It's metro average home price of $370k is now higher than markets like Austin and Phoenix.

-San Jose and Seattle are top performers even though their respective rental markets have taken a large hit. Is this sustainable?

-Phoenix and Tucson are experiencing accelerating growth. Arizona definitely has a history of boom/bust. However, the state-wide economy has matured a lot in the last 15 years.

-Provo and Ogden are the metros directly South/North of Salt Lake. That whole area is seeing massive growth, buoyed by inward migration and its very young and growing population.

-The last four are interesting. New Haven, Dayton, Milwaukee, and Worcester. All "rusty" type cities that have struggled to grow over the last decade. Yet they're tops in real estate growth in 2020.

What is everyone's thoughts? Are you invested in these markets? I would love to hear on the ground feedback.

Post: Best Locations to Buy in Columbus?

Post: Best Locations to Buy in Columbus?

- Investor

- Austin, TX

- Posts 72

- Votes 77

I'm curious what everyone thinks the best places to buy in Columbus right now are?

The areas that have experienced the most appreciation over the last decade are all concentrated near the Urban Core of the city, particularly north/south of Downtown.

Old Towne East (43205)

German Village (43206)

South Hilltop (43223)

Short North (43201)

Grandview (43212)

Linden (43211)

Old Towne East has had by far the highest appreciation, followed by German Village. Short North and Grandview have also had great growth, but I wonder whether they're starting to price people out.

Any areas I missed here? What are your thoughts?

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

Post: Phoenix Real Estate - Fairly Priced? Or Over Priced?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Phoenix real estate values have increased by a 114% - more than doubling - over the last 10 years according to data from Zillow. That's the third highest-growth rate of any metro in the US, propelling the average price in the metro area up to $315k.

But we've seen this story in Phoenix before, with values climbing only to fall precipitously. Values declined by 60% during the GFC from 2007-12.

Fortunately, I think the fundamentals in Phoenix look to be in better shape this time around. Most notably, the permitting and construction of new homes/apartments is much lower today than it was in 2005. At the same time, population in the metro has grown by 1 million in that span.

What are your thoughts on the Phoenix market? Do you think it's fairly valued right now? Or do you think the market is too hot?