All Forum Posts by: Nick Gerli

Nick Gerli has started 17 posts and replied 66 times.

Post: Which Markets are Oversupplied?

Post: Which Markets are Oversupplied?

- Investor

- Austin, TX

- Posts 72

- Votes 77

I think inventory is a very useful "live" indicator of housing supply constraints. But I'm not sure it says much about what the situation will look like in 2-3 years' time.

That's where permitting and household formation becomes useful.

Post: Which Markets are Oversupplied?

Post: Which Markets are Oversupplied?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Lots of great responses in this thread @Luka Milicevic @Ryan Kelly @Bryan Noth @Stefan D. @Aaron Gordy @Remington Lyman

I agree that some level of demand needs to be accounted for in relation to permits (which track new builds, not renovations). While population growth is a good metric to evaluate, household formation might be even better.

A market like Columbus looks great in this comparison. Household formation is greatly exceeding new permitting, which bodes well for durability of occupancy and rent/value growth.

Nashville? I'm not so sure. The opposite trend is occurring, where permits are greatly exceeding household formation.

Post: Which Markets are Oversupplied?

Post: Which Markets are Oversupplied?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Building Permits provide a snapshot into what the supply pipeline (new homes and apartments) in a market will look like in 12-24 months time. The more supply dropped into a market, the more growth needed to keep occupancies and rents up.

The graph below shows Building Permits as a % of Existing Housing stock in select markets.

I'm curious what everyone thinks about this information. Would you be concerned investing in a market like Austin or Nashville given how much permitting there has been lately? Or do you feel like those markets will register enough growth to cover the increase?

Meanwhile, are Pittsburgh and Columbus good markets to get into right now? While their growth rates might be lower, you might feel more confident in the existing rents and value levels given how little supply competition there is.

This data was collected from the US Census, which conducts a monthly building permit survey for every US metro.

Post: How to find Potential Growth Neighborhoods

Post: How to find Potential Growth Neighborhoods

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Luka Milicevic:

To be honest, these graphs and stats that are created by "the experts" make me very skeptical. I have honestly almost always experienced the opposite or not anything close to what the data says. The boots on the ground seems to be more accurate than the folks sitting in offices coming up w this data.

In Nashville, almost every landlord I know has said there has been a slow down in rental demand over the past few months. As a result, prices have come down. (Slightly).

I don't know what neighborhood this is in South Nash, but I imagine it follows the same trend as most of the city.

Luka - you're right! Data will never replace on the ground feel and experience.

I also think you're right that a neighborhood will largely go as the city goes. But - if you wanted to find the best place to invest within a city - don't you think it would be worthwhile to consider the areas where renter demographics exceed supply?

Post: Potential Bubble Markets

Post: Potential Bubble Markets

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Bill B.:

Sounds good.

That was a rough time but it was the only time prices ever dropped more than 5% yoy since vegas was founded people have been predicting the next price crash for at least 10 years even though it’s only only happened once

I admit it’s a tough time to start investing but that will probably always be the case imagine looking at property prices 20 years from now what are the odds prices will be lower? Waiting for a bargain can be a good reason to never start people never questioned my buying more than they did from 2007-2010 obviously prices were going to keep dropping or drop again

Ps. Rents didn't decrease in Las Vegas during the last recession. They actually increased every year. At least SFH rents did. We had insane demand for our homes and raised rents 10% per year and we were still flooded with applicants. People who were losing their house has zero interest in moving to an apartment.

That's fair. I'm sure there's plenty of good deals in Vegas. Real estate is local after all!

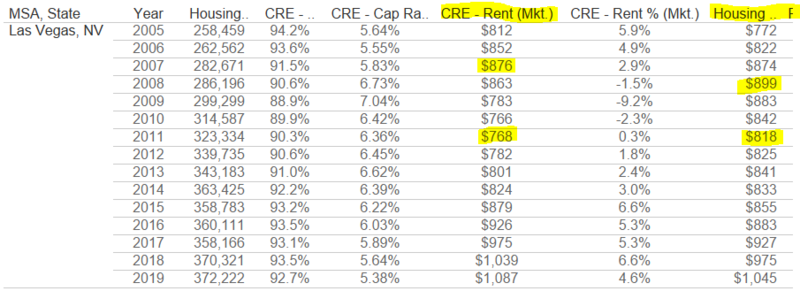

On rent - both sources I use (Census & CoStar) show an 8-12% decline in rents that occurred over a four-year period. This represents average rent in the market, both for traditional and SFR. There could be variation within product types that this isn't capturing.

Post: How to find Potential Growth Neighborhoods

Post: How to find Potential Growth Neighborhoods

- Investor

- Austin, TX

- Posts 72

- Votes 77

The 18 to 44-year old demographic comprises 70% of the rental housing demand in the US.

Accordingly, the higher the share of 18 to 44-year olds in a neighborhood, the higher the demand for rental housing (see the relationship in the graph below).

Yet there are certain neighborhoods that have a high share of 18 to 44 but a low share of rental housing units (green dots in the graph).

For instance, there's a neighborhood south of Nashville that has an 18-44 population of 2,908, but only 276 rental units. There's probably some pent-up rental demand there, which could result in good rent and value growth.

What does everyone think about this methodology? How would you look to take advantage of a shortage of rental demand in a more owner-driven area?

Post: Potential Bubble Markets

Post: Potential Bubble Markets

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Bill B.:

So you’re recommending people buy in areas with low rent growth? I’d rather buy in an area with high rent growth with the fear that growth might stagnate than to buy in an area and expect low rent growth. Are you also recommending buying only in areas with low appreciation?

Are you remembering to factor zero income tax and 1/2 the property taxes into these calculations? Are you cherry picking start and end dates for rent growth?

Ps. 40% rent growth in 10 years is almost zero. (4% per year) But 19% in 10 years, less than 2%, is less than inflation, those people are losing money. You cant tell me property taxes, insurance, and maintenance didn’t go up more than 2% per year over the last 10 years in Pittsburgh. If the houses cost the same 10 years later they are getting killed. If the prices have gone up at all they should have moved to a better market years ago.

Bill - I'm not making a recommendation. I'm just trying to put some data out there and get a meaningful discussion going.

Growth stagnating is one thing. Growth reversing is another. Home values in Las Vegas went down by over 50% in the last recession while rents declined by over 10%.

If someone is looking to buy into Las Vegas in 2020 - after a large run up in rents and values - it's probably wise to consider the fundamentals.

Post: Potential Bubble Markets

Post: Potential Bubble Markets

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Phillip Dwyer:

@Nick Gerli. In Las Vegas we've been getting a lot of traffic moving here from California. Some of those people are working from home for companies not based in LV. I suspect this new found mobility is happening in other parts of the country as well. Will this be the new norm or a short run blip? If it does run longer term, those using models based on the traditional income data will need to tweak their methods.

Phillip - that's a great point. Population growth is also a key factor in determining rents and real estate values.

One thing to note - if you live in Las Vegas but work for a company in California, the Census still counts your income as being in Las Vegas.

Post: Potential Bubble Markets

Post: Potential Bubble Markets

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Mark H. Porter:

I don’t make my decisions based on income areas, I base them in scarcity. Scarcity is happening everywhere at the same time. This is primarily due to those born in the 90’s delaying marriage and children, increasing construction costs, and the fear that we could experience a real estate bubble like 12 years ago. This all leads to more people renting rather than buying.

Mark - I think elements of that thesis are definitely true. However, there has been a strong push towards homeownership - and away from renting - over the last five years. Something to consider.

Post: Potential Bubble Markets

Post: Potential Bubble Markets

- Investor

- Austin, TX

- Posts 72

- Votes 77

Income growth is an important factor in determining rent growth. The two exhibit a fairly strong long-term relationship, shown by the graph below.

But if rents are growing faster than incomes (blue dots in below), that could be a sign that a market is detaching a bit from fundamentals. And potentially heading into bubble territory.

Take Las Vegas, for instance - rents have grown by nearly 40% from 2009-19 while incomes have only grown by 15% in the same span. How about Phoenix? 50% rent growth v. 30% income.

On the other end of the spectrum - Pittsburgh. Rents have only gone up by 19% compared to 35% income growth.

Would you be cautious investing in those blue dot markets? Would you want to be in the green dot markets instead, where incomes have grown faster than rents? Or are there other variables that need to be considered?