All Forum Posts by: Nick Gerli

Nick Gerli has started 17 posts and replied 66 times.

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Aaron Gordy:

I am confused. How does a baby create job growth? The last time that I checked thriving businesses created job growth. Entrepreneurs create job growth. Government expansions create job growth. Communities could have expanding birth rates but if they don't have jobs then how are folks going to pay the bills?

Aaron - that's a great question!

Babies shift households from saving to spending, so they can essentially be thought of as a local stimulus bill. When a baby is born, a bigger home is needed. That creates construction jobs. A new car is needed. That helps create car dealership jobs. A perpetual stream of food, clothes, and care items are needed, which creates retail jobs.

You're right that the underlying quality of the economy matters, too. If babies are born into poverty, that isn't really helping grow jobs. But if you're comparing markets with similar underlying incomes and job prospects - say Salt Lake, Columbus, Portland, and Tampa - the one with more births will win in terms of long-term growth.

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Aaron Gordy:

Idk, Salt Lake City makes me nervous. I wouldn't do it based upon data by itself. I am sure that there are good deals to be had as there are good deals in every market. If you look at the data for net migration in the years 2014 and 2015 you will see a net migration of -4052 and -511 respectively. In 2019 they had a net migration of -81. Based upon that alone, I would say nope. https://www.recenter.tamu.edu/...According to the data source Austin has always had a huge net migration.

Aaron - the thing that sticks out to me about that chart is the Births v. Deaths.

Births tend to create windfalls of additional population and job growth into an economy through increased consumer spending into the local economy (bigger houses, more cars, more food, more clothes - all of the jobs needed to support that). All of that is great for real estate demand in the long-run.

Post: San Francisco - Room to Grow Rent?

Post: San Francisco - Room to Grow Rent?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Tommy Loretz:

I’ve lived in San Francisco for a while and am planning to house hack a small multi-family. Although COVID-19 has had a large impact on the commercial market and impacted residential rental rates, SF is still a desirable core market and should bounce back over the long term. I’m confident that the current struggles will also create some opportunities for creative investment.

Thomas - that's what I'm thinking too. There are lots of negative headlines lately. However, the tech ecosystem and incomes in the area are stronger than ever.

I think you're right that recent events will create some opportunity in the market.

Post: San Francisco - Room to Grow Rent?

Post: San Francisco - Room to Grow Rent?

- Investor

- Austin, TX

- Posts 72

- Votes 77

Is there room to increase rents in San Francisco?

While the SF metro's average rent of $2,200/mo. is very high on its face, it's fairly low compared to the area's $115k median income (by far the highest in the US).

Avg. Annual Rent - $26,000 ($2,200 x 12)

Med. HH Income - $115,000

Rent / Income Ratio - 23%

Relative to income, San Franciso's rent is only slightly more expensive than the US average. And it's cheaper than markets like Orlando and Providence.

Would you invest in SF given how high the incomes are? Or would you stay away because of the high cost of entry?

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Matthew Mazur:

These markets seem to have immediate growth potential, but what is the economic underpinning of their economies? I am aware of local Los Angeles housing developers who have moved to Idaho, Colorado and Utah, respectively. I am surprised to not see Missoula Montana on here as well. However, it's not clear to me what the long term fundamentals of these markets are - Los Angeles will always be home to the largest port system in the world, and thus plenty of jobs. It will also likely remain the global headquarters of production content. Yes, some Angelinos are moving to markets like Phoenix and Vegas, but filling in their 'shoes' are people moving to LA from markets like San Francisco and New York. The production infrastructure, dual port system and great weather are irreplaceable and non-fungible. Unless you think that imports from Asia or production of TV/Streaming content are going away - Los Angeles is the safest market for long-term growth investments.

That's the $10,000 question, Matt!

I think you're right to approach with skepticism. However, there are some real fundamentals in favor of the Mountain states (youth and burgeoning tech scene) that speak to the growth being sustainable.

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Ryan Landis:

@Nick Gerli great post. I personally am a strong believer in the Salt Lake market, but feel like the overall Utah market is going to do phenomenal in the next 5-10 years.

Thanks for the kind words, Ryan!

I'm with you on SLC and the surrounding areas. The whole region has a huge demographic advantage - it's the youngest area of the country (median age of 31 compared to 39 US average). That means lots of jobs and births, which is great for real estate appreciation.

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Megan H.:

@Nick Gerli

Being from Boise, Idaho, it’s a major bummer. Has driven housing prices up so much, most the locals can’t afford housing anymore.. traffic is terrible.

I live in LA now, luckily I purchased an investment property in Boise in 2017 when I did. It’s difficult now to buy anything else though because people are bidding $30-$40,000 over asking price, inspection waved, often same day property is listed, mainly people coming in from California with extra cash.

But overall, I think this market will continue to appreciate, no doubt about that.

Megan - do you mind shining some light on who's moving to Boise?

Is it all California transplants, like the news says? What industries do they work in?

Thank you!

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Aaron Gordy:

I am looking at the data and think why isn't Austin on it. Austin is pushing out huge numbers too. Is it the methodology? I think that Zillow's methodology is a little unusual. I am not an expert in stats but I have taken more than my fair share of classes. Why isn't the median price used? Most stats use median prices or some slight deviation. It seems that each publication has a different data set and outcomes. There are some that are obvious markets such as Boise City. That has been on hot for years. I know that in the Austin market which I monitor daily, I have seen really big numbers. Personally, I like the Core Shiller models. The local stats from each realtors association can also provide good data and its not weighted. Its just straight data compilations and calculations.

Aaron - thanks for the comment!

Austin is very hot. Its metro area is in the 75th percentile of appreciation over the last 10 years according to Zillow.

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Mark H. Porter:

None of that. I’m saying that by the time it is a top market the deals will be harder to find. You need to find those smaller markets that are talked about but others don’t want to bother. The chart is showing appreciation only and usually, but not always, that reflects a tougher point of entry and maybe less cash flow per door.

Agreed - we're definitely seeing inflated valuations across the US.

But I think some of those markets might still be good investments, though. The Salt Lake area in particular. The demographics in that area will likely lead to continued household and income growth, pushing up rents.

Las Vegas and Memphis? I'm not so sure.

Post: The Hottest Real Estate Markets (Last 3 Years)

Post: The Hottest Real Estate Markets (Last 3 Years)

- Investor

- Austin, TX

- Posts 72

- Votes 77

Originally posted by @Scott S.:

Originally posted by @Nick Gerli:

Originally posted by @Scott S.:

Originally posted by @Nick Gerli:

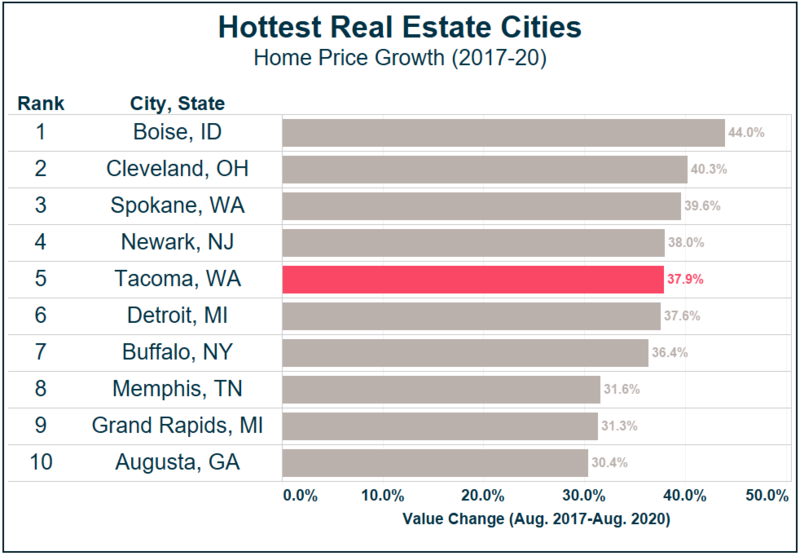

Most of these markets are in either Mountain or Southwest regions.

How does everyone feel about these markets moving forward? Is anyone invested in these markets? Do we think they will keep appreciating?

Just curious, what is the source of this data?

Zillow!

Thanks, can you link to it? I can't seem to find it on Zillow. I'm just wondering what criteria they used (single family/condo, population, etc). I'm surprised the Seattle / Tacoma / Portland metro areas didn't make the top 10 of that list.

For example, Tacoma single family homes median value have increased 48% in the last 3 years ($271k > $402k) using Zillow's data below. That would have easily ranked it #2 in the top 10 list above.

Scott - the data in the original post is based on Metro area, so Tacoma would fall under the Seattle-Tacoma-Bellevue MSA. The whole metro ranks 26th for appreciation for the last three years at around 20%.

Good call, though - if we isolate this list to cities, rather than metros, Tacoma ranks very highly.

Here is a link to the Zillow source: https://www.zillow.com/researc...