All Forum Posts by: Andrey Y.

Andrey Y. has started 114 posts and replied 1826 times.

Post: Is the Real Estate market really not going to take a hit?

Post: Is the Real Estate market really not going to take a hit?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Jim Spatzenfeld:

@James Hamling

@James HamlingYeah, construction costs have gone through the roof.

Republicans scared away cheap Mexican workers with their wall that Mexico paid for.

Democrats added new building codes to make homes even more unaffordable, like here in CA all new homes must have Solar cells, and not just a couple, it must be enough to make the house net-zero (produce as much as the house uses), as well as many other new code to make sure only millionaires will be left to buy a new house here.

Lumber more than doubled in the last two month. 7/16 OSB (plywood) was always $8-$10 per sheet, now its $27 at Home Depot.

Lumber prices doubling in two months is INSANE. I don't think that will be sustained or we're all screwed. The $6T printed in 2020 ain't gonna help that either..

Post: Is the Real Estate market really not going to take a hit?

Post: Is the Real Estate market really not going to take a hit?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Jim Spatzenfeld:

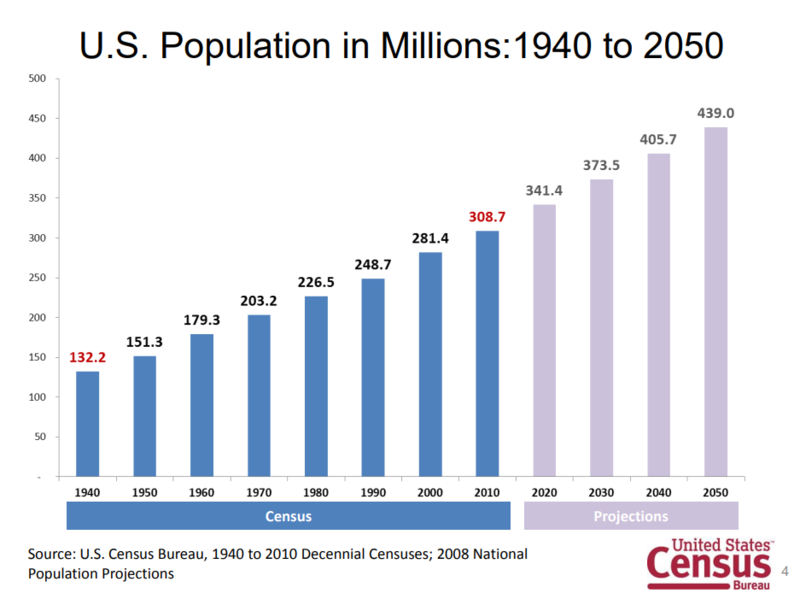

As we all know, the price is determined by supply and demand. Demand is almost equal to population, as every single person needs a home, either buying one or renting one. Supply is existing homes, less demolished homes, plus new construction.

So we have to compare population growth to housing growth (=new home construction). They have to be equal.

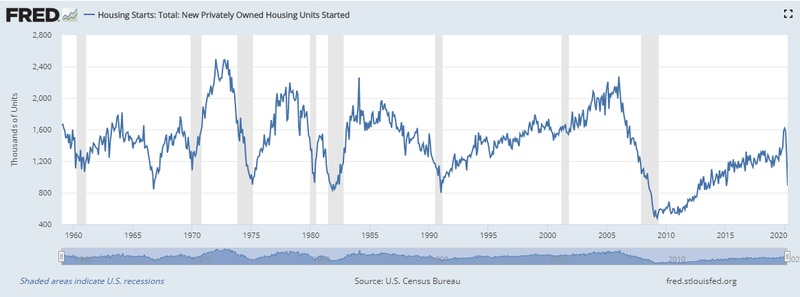

Since 1950, the US has always built between 1-2 million new homes every year. From 2009-2019 we have built less homes than during any prior decade going back to 1950 when we only had a population of 150 million.

The only way for us to catch up with the supply of homes is if we can get new home construction to at least 2 million a year for many years to come. If you look a the current cost of new home construction, you will come to the conclusion that this won't be cheap! A housing price collapse? Unlikely.

10 years of never seen before mediocre housing construction numbers created the largest REAL housing shortage in history!

Homeless people everywhere! No vacancies! People fighting to get a house, trying to outbid the other 50 bidders even during a pandemic with record unemployment!

Even a coming wave of foreclosures would not create any new housing, it will just turn existing housing into vacant homes (=make things worse) as well as into rentals.

Sorry if I am disappointing some folks here that are hoping to buy their first home soon. It's just that the numbers don't look well for first-time buyers, sorry! Please don't hate me personally for this dilemma! Don't kill the messenger, please!

Your post and graphs just red pilled the heck out of me! Thanks

Post: 60 Lot RV Park with 3 MH

Post: 60 Lot RV Park with 3 MH

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

I dont believe that your buddy has the gumption to advertise a property with a cap rate worse than a war zone.

Post: How are September rents coming in

Post: How are September rents coming in

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

100%

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Joe Splitrock:

Originally posted by @Andrey Y.:

Originally posted by @Joe Splitrock:

Originally posted by @Andrey Y.:

Originally posted by @Joe Splitrock:

Originally posted by @Andrey Y.:

Originally posted by @Josephine Wilson:

Newbie question here: I'm looking to buy a Class A triplex or quad within 10 minutes of my house and doing property management and maintenance myself. I live close to a large university. Of the 20 recently-sold small multis I've analyzed, nearly all have little to no cash flow and cap rates averaging 4.6%. (2048/2050 E 6th St, Tucson, AZ 85719 is one example.) Some even have substantial negative cash flow. Everything I'm reading says these cap rates are not favorable. So why are people buying these properties?

I'm thinking the buyers are A) hoping for appreciation and don't mind no cash flow, B) planning to increase NOI or hoping that market rents will rise, C) wealthy parents buying a place for Johnny/Susie to live for four years or D) house hacking. Can folks offer their insights into why buy properties with negative cash flow and low cap rates?

For anyone interested, here are my estimates for my example property: 2048/2050 E 6th St, 85719

Price: $245,500, two 1BR units, 1219 sq ft total

Rent: $1454

Maintenance: $205

P&I: $938

Taxes: $195

Cash flow: -$39

Cash on cash: -0.7%

Cap rate: 4.4%

1. Cap rates are not a return metric. Cap rates are obtained from cap rate sales comps on large buildings. They are NOT a return metric.

2. You cannot invent or calculate your own cap rate. See above.

3. Did you get your definition of Cap rate from the BP podcast or a Turnkey salesman? Please ask a knowledgeable investor or commercial real estate appraiser what a cap rate actually is.

4. Lower cap rate = more desirable, higher quality asset.

Please don't teach new investors any more misinformation than they are already bombarded with on a daily basis.

1. CAP rate is Net Operating Income divided by property value, so when a property is listed for sale it is net operating income expressed as a percentage of sales price.

2. You can absolutely calculate CAP rate. How do you think they come up with the numbers? It is NOI/value. When selling a property they use offer price as the value.

3. CAP rate has been around since before the internet and there is no question about how it is calculated. Insulting others doesn't prove your point.

4. Lower CAP rate does not mean the asset is higher quality. It means the return relative to current value is low. One reason could be that it is a high quality asset. Higher quality assets have lower risk and therefore lower return. Other explanations could be the that property is overpriced, has excessive expenses or has under market rents. Basically anything that affects NOI or value will change CAP rate.

Nobody is saying CAP rate is a perfect measure. It is one of many different metrics you can use to evaluate and compare investments.

Again, a capitalization rate is not a return metric. It is a measure of desirability, and a lower cap rate is a lower level of perceived risk.

He cannot calculate a cap rate because cap rates are obtained by cap rate comps in that submarket, typically on 50-100+ unit properties.

You cannot calculate your own cap rate, the (sub)market dictates cap rate, and there are no cap rates on SFHs. SFHs have nothing to do with cap rate because their purchase and sale price has NOTHING to do their their income/NOI. There are NO cap rate comps on a SFH lol, this is basic stuff my man.

I understand you are a moderator but you have some responsibility to not spread dangerous information and advice such as higher cap rate is better, and everyone should jump at a 22% cap rate property !!!! Believe it or not, I've seen nonsense like this on one of the BP podcasts.

Becuase if the OP truly believed this property had a "4.3 cap rate" (it doesn't) this means that he can get more than $20 for every $1 in NOI (LOL) which he can't and won't, because that is not that "cap rate" on his SFH.

You could call CAP rate a return metric, although it is not the best metric. It is really used more for quickly comparing investments. Consider this example. Two identical properties are located next door to each other and one is advertised at $100,000 at 5% CAP rate, the other is advertised for $50,000 at 10% CAP rate. Let's assume the "market CAP rate" is 7%. (Keep in mind the market CAP rate is just average of CAP rates for comparable properties that have sold recently in the market). Given this information we can conclude the 5% CAP property is overprice and the 10% CAP is under priced to the market. This is the purpose of CAP rate. To understand at a high level how returns compare between investments. If the properties were not identical, there could be other explanations or things to consider before buying.

Generally speaking higher returns mean higher risk with any investment, but as real estate investors we are chasing higher returns and accepting higher risk. If you want low risk, purchase a 2% FDIC savings account. Most people would agree that an FDIC account is lower risk, but not necessarily a better investment. Demand drives price higher, so more desirable properties often have lower return. Of course there are exceptions. The goal of investor is to look within a market to find the "hidden gem". That could be a property with low CAP rate, but opportunity to increase rents. That could be a property with higher CAP rate that is undervalued. Using any one metric is oversimplifying. Condition of the property, cash flow, cash on cash return, future appreciation, financing terms, tax benefits, etc. are just some of the other things to consider.

I think you are getting hung up on market CAP rate, but forgetting that market CAP rate is just an average of all the individual CAP rates. It moves up and down and income or value of individual properties change.

As far as SFH comments, you are the one who brought that into this conversation. The OP said it is multifamily (not SFH as you state) and she is a woman (not a man as you state).

The OP said they were looking at a Triplex or Quad. Those properties don't have "market caps" as you state because they are NOT valuated by their ability to produce a given NOI !! With the exception of a Turnkey salesman trying to sell (swindle) a property at a higher value to a newbie who doesn't know better.

What you are implying, and what most others are saying in this thread is that the OP should be looking for a "higher Cap rate property" in order for the investment to be good.

No no no!! A higher cap rate is 9 times out of 10 a worse investment! Do you think family offices, insurance companies, and institutional Investors are stupid? The ones would millions of dollars paying attorneys, advisors, and board members? You know better than them, go ahead and tell them higher cap rates are better LOL

These $100MM - $5BB+ NW family offices, insurance companies, and institutional Investors are all going after 3, 4, and 4.5% capitalization rate investments. Why do you think that is Joe? Is it because they are into buying poor, inferior investments? Maybe they should have listened to all the BP podcasts and moderators posts telling them to invest in "higher CAP" properties ;)

I have stated multiple times in this thread that CAP rate is one piece of information, but it is not the only or the best metric to use in evaluating an investment.

Most triplex and quad on the MLS (in my market) have a CAP rate listed. You can argue all day that CAP rate is not useful on small multifamily or single family. I generally agree with that. HOWEVER, there is still a CAP rate. You can calculate NOI for any income producing property and CAP rate is just found by dividing it by purchase price. I would argue if you are comparing within asset class (triplex to triplex) that the relative CAP rates may be interesting to look at. Obviously someone looking at triplex is not also shopping for $100M apartment buildings, so it is not like people are comparing the two.

Let's follow your logic that a "higher cap rate is 9 times out of 10 the worst investment". Following that logic, everyone should chase the highest possible purchase price relative to net operating income. No doubt insurance companies and some institutional investors are seeking low risk, but even they want to maximize return within the asset class. Sometimes lower CAP rate is an indicator of an overpriced investment.

CAP rate compression is often better for people exiting a market, rather than entering a market. It is better to enter a market when CAP rates are higher and exit as they compress. That is kind of investing 101. Buy when nobody else is and sell when everyone is buying. Or buy undervalued assets and improve them. That is how you grow your money faster.

I am getting the feeling you had a bad turn key investment experience. You are the only one on this discussion thread talking about turn key, haha. I am sorry you had a bad experience, but don't project your issues on me. I have never invested in turn key and never really advocated it either.

You keep incorrectly stating that it is a measure of return when it is a valuation metric. If I buy Class A office in Ohio at a 10% cap rate then the cap rate tells me I paid $10 for a dollar of NOI. In CA I may pay $20 for a dollar of Class A office at 5% cap rate. You cannot tell me which property/market has a higher return.

You wouldn't believe this Joe, but your feeling is incorrect once again. I've only purchased and owned 1 Turnkey property to date, it's in Little Rock, and I am very happy with it.

If you are okay with staying non-truths to newbie investors, thats on you. I for one am adamantly against perpetuation of false information. And if you've been following, there is a lot of that going on right now.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Joe Splitrock:

You could call CAP rate a return metric..

You cannot call a cap rate a return metric because it does not measure return. Which property has a higher return. A property bought at 10% in Indy or a property bought at 5% in SF? Do you want me to believe that the Indy has DOUBLE the return of the SF property? In your example ALL you are doing is comparing "asking prices". No one does that. Why would you? If two comparable properties have $100,000 NOI and the market cap rate is 7% then they both have a market value of about $1,428,600. That is the purpose of cap rate, to calculate probable market value. Investors don't waste time comparing asking prices. You should know that.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Nobody is saying CAP rate is a perfect measure. It is one of many different metrics you can use to evaluate and compare investments.

A cap rate is not evaluating anything except market value and at best you can use cap rates to compare MARKETS as in Class A multifamily might trade at a 7% cap rate in Alabama and a 4% cap rate in CA, Since all comparable properties in either Alabama or CA will trade at 7% and 4% then there is no building comparability.

But back to what that cap rate is telling you. It is perfectly telling you that investors have paid $14.29 for a dollar of NOI in Alabama and that same dollar of NOI sold for $25 in CA. It is a perfect valuation metric. It loses its perfection when you are trying to make it do something is does not do. There is no return measurement there.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Joe Splitrock:

Originally posted by @Andrey Y.:

Originally posted by @Joe Splitrock:

Originally posted by @Andrey Y.:

Originally posted by @Josephine Wilson:

Newbie question here: I'm looking to buy a Class A triplex or quad within 10 minutes of my house and doing property management and maintenance myself. I live close to a large university. Of the 20 recently-sold small multis I've analyzed, nearly all have little to no cash flow and cap rates averaging 4.6%. (2048/2050 E 6th St, Tucson, AZ 85719 is one example.) Some even have substantial negative cash flow. Everything I'm reading says these cap rates are not favorable. So why are people buying these properties?

I'm thinking the buyers are A) hoping for appreciation and don't mind no cash flow, B) planning to increase NOI or hoping that market rents will rise, C) wealthy parents buying a place for Johnny/Susie to live for four years or D) house hacking. Can folks offer their insights into why buy properties with negative cash flow and low cap rates?

For anyone interested, here are my estimates for my example property: 2048/2050 E 6th St, 85719

Price: $245,500, two 1BR units, 1219 sq ft total

Rent: $1454

Maintenance: $205

P&I: $938

Taxes: $195

Cash flow: -$39

Cash on cash: -0.7%

Cap rate: 4.4%

1. Cap rates are not a return metric. Cap rates are obtained from cap rate sales comps on large buildings. They are NOT a return metric.

2. You cannot invent or calculate your own cap rate. See above.

3. Did you get your definition of Cap rate from the BP podcast or a Turnkey salesman? Please ask a knowledgeable investor or commercial real estate appraiser what a cap rate actually is.

4. Lower cap rate = more desirable, higher quality asset.

Please don't teach new investors any more misinformation than they are already bombarded with on a daily basis.

1. CAP rate is Net Operating Income divided by property value, so when a property is listed for sale it is net operating income expressed as a percentage of sales price.

2. You can absolutely calculate CAP rate. How do you think they come up with the numbers? It is NOI/value. When selling a property they use offer price as the value.

3. CAP rate has been around since before the internet and there is no question about how it is calculated. Insulting others doesn't prove your point.

4. Lower CAP rate does not mean the asset is higher quality. It means the return relative to current value is low. One reason could be that it is a high quality asset. Higher quality assets have lower risk and therefore lower return. Other explanations could be the that property is overpriced, has excessive expenses or has under market rents. Basically anything that affects NOI or value will change CAP rate.

Nobody is saying CAP rate is a perfect measure. It is one of many different metrics you can use to evaluate and compare investments.

Again, a capitalization rate is not a return metric. It is a measure of desirability, and a lower cap rate is a lower level of perceived risk.

He cannot calculate a cap rate because cap rates are obtained by cap rate comps in that submarket, typically on 50-100+ unit properties.

You cannot calculate your own cap rate, the (sub)market dictates cap rate, and there are no cap rates on SFHs. SFHs have nothing to do with cap rate because their purchase and sale price has NOTHING to do their their income/NOI. There are NO cap rate comps on a SFH lol, this is basic stuff my man.

I understand you are a moderator but you have some responsibility to not spread dangerous information and advice such as higher cap rate is better, and everyone should jump at a 22% cap rate property !!!! Believe it or not, I've seen nonsense like this on one of the BP podcasts.

Becuase if the OP truly believed this property had a "4.3 cap rate" (it doesn't) this means that he can get more than $20 for every $1 in NOI (LOL) which he can't and won't, because that is not that "cap rate" on his SFH.

You could call CAP rate a return metric, although it is not the best metric. It is really used more for quickly comparing investments. Consider this example. Two identical properties are located next door to each other and one is advertised at $100,000 at 5% CAP rate, the other is advertised for $50,000 at 10% CAP rate. Let's assume the "market CAP rate" is 7%. (Keep in mind the market CAP rate is just average of CAP rates for comparable properties that have sold recently in the market). Given this information we can conclude the 5% CAP property is overprice and the 10% CAP is under priced to the market. This is the purpose of CAP rate. To understand at a high level how returns compare between investments. If the properties were not identical, there could be other explanations or things to consider before buying.

Generally speaking higher returns mean higher risk with any investment, but as real estate investors we are chasing higher returns and accepting higher risk. If you want low risk, purchase a 2% FDIC savings account. Most people would agree that an FDIC account is lower risk, but not necessarily a better investment. Demand drives price higher, so more desirable properties often have lower return. Of course there are exceptions. The goal of investor is to look within a market to find the "hidden gem". That could be a property with low CAP rate, but opportunity to increase rents. That could be a property with higher CAP rate that is undervalued. Using any one metric is oversimplifying. Condition of the property, cash flow, cash on cash return, future appreciation, financing terms, tax benefits, etc. are just some of the other things to consider.

I think you are getting hung up on market CAP rate, but forgetting that market CAP rate is just an average of all the individual CAP rates. It moves up and down and income or value of individual properties change.

As far as SFH comments, you are the one who brought that into this conversation. The OP said it is multifamily (not SFH as you state) and she is a woman (not a man as you state).

The OP said they were looking at a Triplex or Quad. Those properties don't have "market caps" as you state because they are NOT valuated by their ability to produce a given NOI !! With the exception of a Turnkey salesman trying to sell (swindle) a property at a higher value to a newbie who doesn't know better.

What you are implying, and what most others are saying in this thread is that the OP should be looking for a "higher Cap rate property" in order for the investment to be good.

No no no!! A higher cap rate is 9 times out of 10 a worse investment! Do you think family offices, insurance companies, and institutional Investors are stupid? The ones would millions of dollars paying attorneys, advisors, and board members? You know better than them, go ahead and tell them higher cap rates are better LOL

These $100MM - $5BB+ NW family offices, insurance companies, and institutional Investors are all going after 3, 4, and 4.5% capitalization rate investments. Why do you think that is Joe? Is it because they are into buying poor, inferior investments? Maybe they should have listened to all the BP podcasts and moderators posts telling them to invest in "higher CAP" properties ;)

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Joe Splitrock:

Originally posted by @Andrey Y.:

Originally posted by @Josephine Wilson:

Newbie question here: I'm looking to buy a Class A triplex or quad within 10 minutes of my house and doing property management and maintenance myself. I live close to a large university. Of the 20 recently-sold small multis I've analyzed, nearly all have little to no cash flow and cap rates averaging 4.6%. (2048/2050 E 6th St, Tucson, AZ 85719 is one example.) Some even have substantial negative cash flow. Everything I'm reading says these cap rates are not favorable. So why are people buying these properties?

I'm thinking the buyers are A) hoping for appreciation and don't mind no cash flow, B) planning to increase NOI or hoping that market rents will rise, C) wealthy parents buying a place for Johnny/Susie to live for four years or D) house hacking. Can folks offer their insights into why buy properties with negative cash flow and low cap rates?

For anyone interested, here are my estimates for my example property: 2048/2050 E 6th St, 85719

Price: $245,500, two 1BR units, 1219 sq ft total

Rent: $1454

Maintenance: $205

P&I: $938

Taxes: $195

Cash flow: -$39

Cash on cash: -0.7%

Cap rate: 4.4%

1. Cap rates are not a return metric. Cap rates are obtained from cap rate sales comps on large buildings. They are NOT a return metric.

2. You cannot invent or calculate your own cap rate. See above.

3. Did you get your definition of Cap rate from the BP podcast or a Turnkey salesman? Please ask a knowledgeable investor or commercial real estate appraiser what a cap rate actually is.

4. Lower cap rate = more desirable, higher quality asset.

Please don't teach new investors any more misinformation than they are already bombarded with on a daily basis.

1. CAP rate is Net Operating Income divided by property value, so when a property is listed for sale it is net operating income expressed as a percentage of sales price.

2. You can absolutely calculate CAP rate. How do you think they come up with the numbers? It is NOI/value. When selling a property they use offer price as the value.

3. CAP rate has been around since before the internet and there is no question about how it is calculated. Insulting others doesn't prove your point.

4. Lower CAP rate does not mean the asset is higher quality. It means the return relative to current value is low. One reason could be that it is a high quality asset. Higher quality assets have lower risk and therefore lower return. Other explanations could be the that property is overpriced, has excessive expenses or has under market rents. Basically anything that affects NOI or value will change CAP rate.

Nobody is saying CAP rate is a perfect measure. It is one of many different metrics you can use to evaluate and compare investments.

Again, a capitalization rate is not a return metric. It is a measure of desirability, and a lower cap rate is a lower level of perceived risk.

He cannot calculate a cap rate because cap rates are obtained by cap rate comps in that submarket, typically on 50-100+ unit properties.

You cannot calculate your own cap rate, the (sub)market dictates cap rate, and there are no cap rates on SFHs. SFHs have nothing to do with cap rate because their purchase and sale price has NOTHING to do their their income/NOI. There are NO cap rate comps on a SFH lol, this is basic stuff my man.

I understand you are a moderator but you have some responsibility to not spread dangerous information and advice such as higher cap rate is better, and everyone should jump at a 22% cap rate property !!!! Believe it or not, I've seen nonsense like this on one of the BP podcasts.

Becuase if the OP truly believed this property had a "4.3 cap rate" (it doesn't) this means that he can get more than $20 for every $1 in NOI (LOL) which he can't and won't, because that is not that "cap rate" on his SFH.

Post: Why are people buying at these prices?

Post: Why are people buying at these prices?

- Specialist

- Honolulu, HI

- Posts 1,887

- Votes 1,264

Originally posted by @Josephine Wilson:

Newbie question here: I'm looking to buy a Class A triplex or quad within 10 minutes of my house and doing property management and maintenance myself. I live close to a large university. Of the 20 recently-sold small multis I've analyzed, nearly all have little to no cash flow and cap rates averaging 4.6%. (2048/2050 E 6th St, Tucson, AZ 85719 is one example.) Some even have substantial negative cash flow. Everything I'm reading says these cap rates are not favorable. So why are people buying these properties?

I'm thinking the buyers are A) hoping for appreciation and don't mind no cash flow, B) planning to increase NOI or hoping that market rents will rise, C) wealthy parents buying a place for Johnny/Susie to live for four years or D) house hacking. Can folks offer their insights into why buy properties with negative cash flow and low cap rates?

For anyone interested, here are my estimates for my example property: 2048/2050 E 6th St, 85719

Price: $245,500, two 1BR units, 1219 sq ft total

Rent: $1454

Maintenance: $205

P&I: $938

Taxes: $195

Cash flow: -$39

Cash on cash: -0.7%

Cap rate: 4.4%

1. Cap rates are not a return metric. Cap rates are obtained from cap rate sales comps on large buildings. They are NOT a return metric.

2. You cannot invent or calculate your own cap rate. See above.

3. Did you get your definition of Cap rate from the BP podcast or a Turnkey salesman? Please ask a knowledgeable investor or commercial real estate appraiser what a cap rate actually is.

4. Lower cap rate = more desirable, higher quality asset.

Please don't teach new investors any more misinformation than they are already bombarded with on a daily basis.