All Forum Posts by: J. Martin

J. Martin has started 178 posts and replied 3656 times.

Post: Is your primary house an investment?

Post: Is your primary house an investment?

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

@Victoria S. I think a big part of this depends on if you're willing to sacrifice and buy a 2-4, or 5+ unit building, house hack, or just buy a single family home and live in it. SFH is tough, unless you're going to rent rooms until the next cycle makes you better equity..

I make a lot of cash flow off of my first owner-occupant fourplex in Richmond - and would make cash flow buying it today - and even more operating it as a furnished rental like I do. I've also made lots on appreciation buying at the right time, but not sure how much left this cycle has left to go, and hard to get that kind of cash flow with a SFH especially... www.realestategraphs.com

What are your plans with your primary? What do you think about the economic/real estate cycle?

Post: Best brokerage to work for in San Francisco / the Bay Area?

Post: Best brokerage to work for in San Francisco / the Bay Area?

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

Go kick some ***!! Let's have dinner when you're not busy! :)

@Account Closed, great list!! I love Patrick Carlyle's analysis at Paragon. They have a strong focus on SF and higher-end properties it seems. I don't believe they operate on the peninsula. (surprisingly, with the high-end properties there..)

Post: I QUIT MY JOB THIS WEEK!!! (with help from BP, at 31yo ;)

Post: I QUIT MY JOB THIS WEEK!!! (with help from BP, at 31yo ;)

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

Originally posted by @Kyle J.:

Congrats @J. Martin. Very cool.

I still remember when I met you at that small meetup in Stockton a few years ago. It definitely seemed like you were on your way even then, and you've come a long way since.

Coincidentally, I actually retired myself last month, and have been enjoying traveling too. (Just recently got back from Costa Rica. It was awesome!)

Cheers to you and living life in flip flops. :)

Thanks for the shout-out Kyle! I love going to meetups when I'm out and about and has paid off.. Actually, I randomly got to meet @Brian Burke for the first time in person when he was one of the 4 attendees at a meetup I scheduled in Santa Rosa when I was up there for my W2 job back in the day. He ended up being my star speaker 2 years in a row when I started the . Also met @Account Closed at a meetup for the first time, and has since become a friend and mentor. You never know who you'll meet! And congrats on quitting your job and the trip to Costa Rica!! Awesome!!! :) The 9-5 workers love living vicariously through those traveling, so you might want to make a like I did!

Ha Noi!

Havasupai in the Grand Canyon :)

Post: In State or Out of State

Post: In State or Out of State

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

Originally posted by @Arlen Chou:

@Account Closed just because you don't see it does not mean its not happening... I got this article from @J. Martin recently that might shine a little light on the topic.

http://www.wsj.com/articles/u-s-cities-see-apartme...

Again, I believe in the local market and I think you should look locally. I hope you are not taking my post as a knock. I am just suggesting prudence and that deep dive analysis is critical at this time in the cycle.

I hope you can come down to @Johnson H. meet up next week. I will buy you a beer and we can talk more about the topic.

Take it easy,

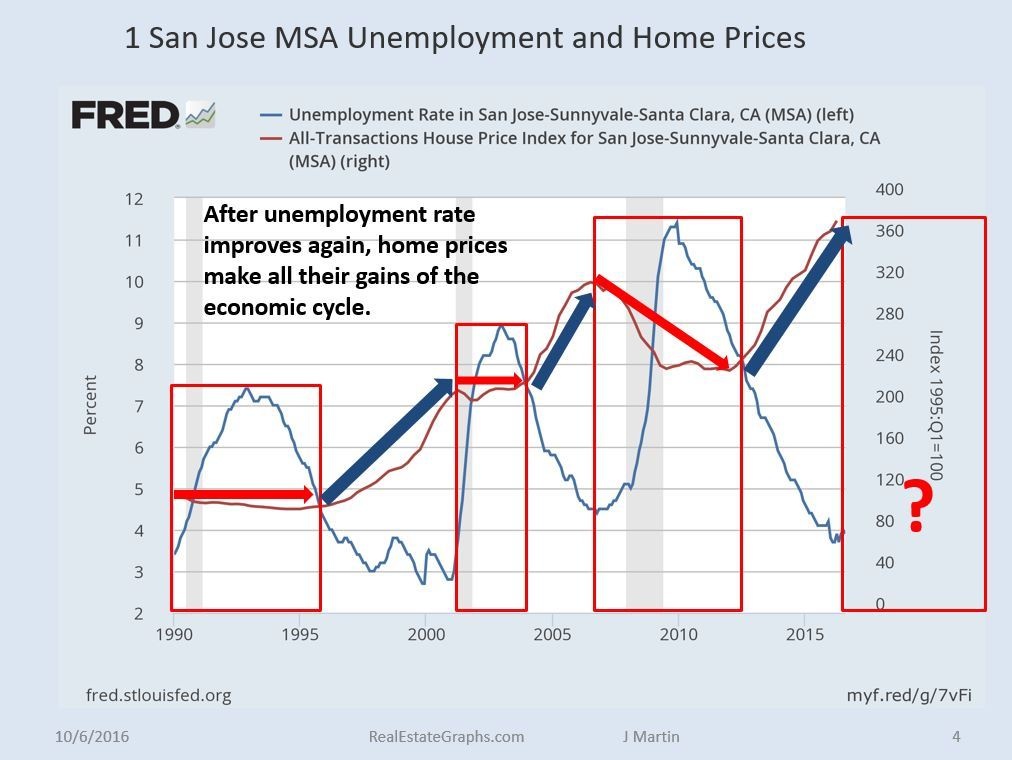

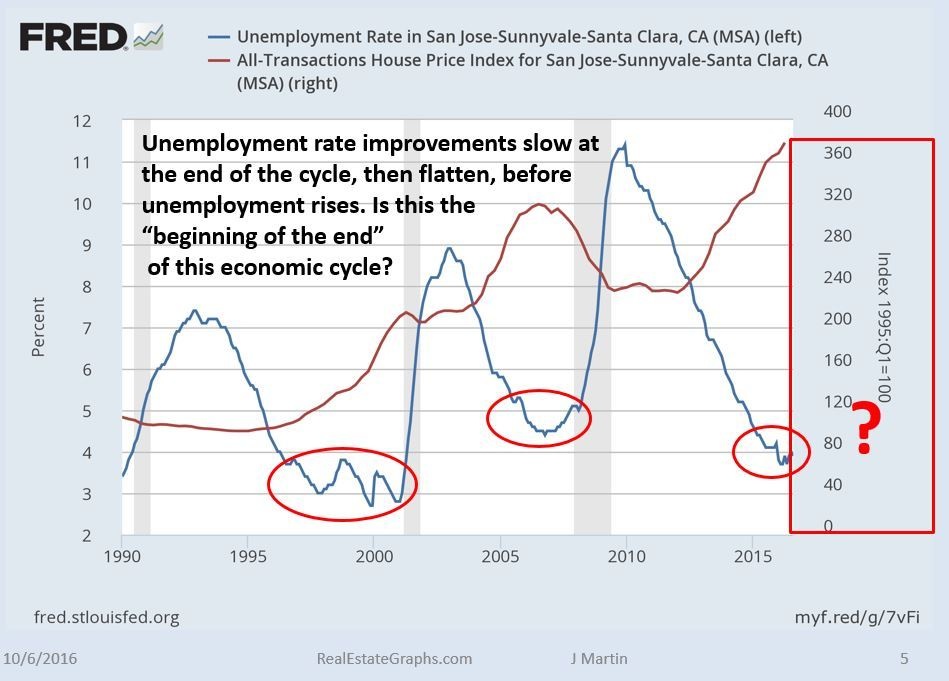

I'm just being patient right now and waiting for this cycle to run its course... If you look historically in the Bay Area, most RE gains start a year or two after the unemployment rate peaks and starts declining. Then you make a bunch of money!

The Red boxes mark the beginning of a rise in the unemployment rate, then end when RE prices start going up. You can see that you don't have to call a peak in unemployment. You can see YOY improvements in the unemployment rate before RE prices make their run of the cycle. Prices are generally flat or down when the unemployment rate rises.

Does the chart look similar this time to the beginning of prior recessions?

I'll be sending this data out soon. Title: "Beginning of the End?" (of this cycle)

Post: We Are Only One Decision From a Totally Different Life

Post: We Are Only One Decision From a Totally Different Life

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

The pictures sell the place, along with the reviews. These were done by Rika, the same photographer I hired to shoot the SF Bay Summit. (will post some of those soon.) All the couches should be fold-out sofas, but I think maybe the red one is not. Talked to Sergio about that. Fold-outs are a rule in furnished rentals..

I wish there was an accent wall in the loft too. At the others, we talked to your guys before they painted. Can't remember what happened here. Maybe will have Sergio do it at the next turn.. I think it really adds a lot, especially for the cost. Best ROI in RE probably lol

I agree, you can't afford to be a photographer. Opportunity cost is too high ;)

Curious what you're up to. Foreclosure courses? New biz? Different RE play? Maybe you can tell me before Bruce Norris at SJREI. Sent you a couple dinner options by email near the venue..

Post: How To Make $2 Million in Real Estate in 2 years in the Bay Area

Post: How To Make $2 Million in Real Estate in 2 years in the Bay Area

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

Originally posted by @Account Closed:

Originally posted by @Adam Ross:

Originally posted by @Account Closed:

Originally posted by @Vamshi Ananth:

These numbers does not factor in the 1-2 months rent rebates that are prevalent in the bay area market..... which if factored in the numbers might look a bit more ugly.

Where on earth are you seeing this?

Bob - I just received this concession offer from an apartment complex in San Jose in the mail yesterday...

Adam, even if we read this offer as "up to $1500 off first month AND additional $500 off if leased by 9/25" then that only totals $2,000 off but the minimum rent is $2360 so there is no 1 or 2 months discount. AND it is only on select units! Wonder which ones those are or if this is just a bait and switch.

Perhaps you saw on the news Mountain View dealing with all the techies living in their RV's along the public streets.

I did look in the Sunday paper but it seems the large apartment complexes don't advertise there.

Also the first month free is more of a marketing tactic that a statement on the market conditions.

I appreciate you following up on this.

Bob,

Discounts that large aren't super common in my experience in this market for an existing (not newly built) property. More common for large apartment buildings than small. However I did notice that this complex had particularly bad reviews, and the majority of the good reviews were left on the same day last month, after years of bad reviews. Odd..

https://www.yelp.com/biz/the-verdant-apartments-sa...

Fire alarm apparently goes off frequently, lots of broken gym equipment, not enough maintenance people, and someone saying that homeless people sometimes sleep in the staircase.. Good times!

@Account Closed,

What do you think about this location?

3700 Casa Verde Street San Jose, CA 95134

http://www.verdant-apts.com/

Is this just a mark-em-up, mark-em-down ploy on the rent prices?

A1

Beds / Baths1bd / 1ba

Rent$2,345 - $2,880

Deposit$500

Sq. Feet681+

A2

Beds / Baths1bd / 1ba

Rent$2,445 - $3,005

Deposit$500

Sq. Feet756+

A3

Beds / Baths1bd / 1ba

Rent$2,515 - $2,690

Deposit$500

Sq. Feet827+

A4

Beds / Baths1bd / 1ba

Rent$2,465 - $2,660

Deposit$500

Sq. Feet695

A5

Beds / Baths1bd / 1ba

Rent$2,630 - $2,680

Deposit$500

Sq. Feet764+

Post: We Are Only One Decision From a Totally Different Life

Post: We Are Only One Decision From a Totally Different Life

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

Originally posted by @Account Closed:

For the tag to work, you two have to be colleagues, or @J. Martin has to have a post on this thread. J is definitely a shrewd businessman. I recently sneaked into one of his corporate rental units on a turnover. He has a decent taste when it comes to staging. Knowing J, I believe that's a sofa bed, but I could be wrong. Here are a couple of pix.

My handyman actually decorated this one, trying to copy the style of some of my others. I don't really like the artwork. But thanks for working with me on the accent wall! I love it!! And take some brighter pictures Minh!! Don't quit investing to be a staging photographer!! lol

This is a real bed. Not a sofa bed. But I always tell my handyman to get sofas that also fold out to beds, whenever buying one..

Recognize this one?

Eh?

You probably don't recognize this one below Minh.

This is the very first apartment I lived in when I moved into my first 4plex I bought in Richmond.

It's about 3 blocks south of the BART station. A 2br/1ba. I rent this apartment for about $2,500/mo furnished, for 2-3 months at a time. It is the smallest of 4 units. I purchased the property for $375K on New Years' Eve 2012. (Happppy New Year!!!)

As I look at the pictures, there are some things that need to be worked on. Will do another post on that..

Post: We Are Only One Decision From a Totally Different Life

Post: We Are Only One Decision From a Totally Different Life

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

I'll be up at @Al Williamson 's Summit at the Guild in 2017 (save the date yet Al..?). Definitely plan to be there if I don't see you before that. Not sure why you can't tag me. Maybe my name is too short?!? lol Thanks for the kudos! Glad you like the posts :) I've been traveling lately and was busy with the Summit, but give me a call or text me a few times and I'll get back to you :)

Here's the most recent data for Sacramento for job growth, economic conditions, and home price increases in the Sacramento / Roseville / Arden / Arcade Metro area. It looks like the highest % gains in home prices are over, like most geographic areas coming off the bottom, although an 8% annual clip is not bad. Will the economy get a second wind of accelerating job growth?

Or will job growth follow declining economic conditions, and decelerate? What happens to home price increases when job growth decelerates? (Not that right y axis is different scale than left)

@Account Closed,

"We Are Only One Decision From a Totally Different Life"

So true! :)

Post: My Logo Suck? Give me feedback and help shape it!

Post: My Logo Suck? Give me feedback and help shape it!

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

LAST ROUND TO PICK A DESIGNER!!

TAKE THE NEW POLL HERE:

https://en.99designs.de/contests/poll/rlfe8l?urlca...

All of you who voted.. Thank you so much! Now round 2 above!! Vote one more time please on these tweaked designs :)

@DG A., @Onna-lisa Kyom, @Colton S.

https://en.99designs.de/social-media-pack/contests...

Round Two!!

What do you think?

Click on the link and let me know!

https://en.99designs.de/social-media-pack/contests...

Any other awesome folks in San Francisco, New York City, Austin, Boston, Seattle, San Diego, Los Angeles or Sacramento please chime in on this and vote (click link above).

THANK YOU SO MUCH!!!

I will share the results of the polling on this thread..

Post: New member from San Francisco looking to invest out-of-state

Post: New member from San Francisco looking to invest out-of-state

- Rental Property Investor

- Oakland, CA

- Posts 3,834

- Votes 2,925

Originally posted by @Jonna Weber:

@Aaron Hurst - Welcome! Are you involved in the SFO area meet ups with @J. Martin? I want to the Investing Summit a couple of weeks ago in Oakland, and met so many great people that live in the Bay area that are doing what you want to do. I would highly suggest getting to know you local investors...it will expedite the learning curve! All the best to you.

Aaron, welcome to the Bay Area BP crew! As Jonna said, there are lots of awesome investors here in the Bay Area, and I definitely recommend meeting other locals at meetups too. We usually meet up once a month in SF with my group, and @Ryder Meehan has a meetup in SF focused on out of state investing (I'll actually be speaking there next month on furnished rentals)

Thanks for the shout out Jonna :)