All Forum Posts by: Danny Webber

Danny Webber has started 86 posts and replied 763 times.

Post: Looking for cash-out refinance

Post: Looking for cash-out refinance

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

Delayed financing is if you paid cash for the property and want to get those funds alone out. You cannot get any rehab funds spent back. The best thing to do in those circumstances is to have the seller complete or prepay for any major repairs as part of the purchase price.

Post: Need advise about duplex / fourplex in San Antonio, TX

Post: Need advise about duplex / fourplex in San Antonio, TX

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

check out Killeen/Copperas Cove TX for cash flow

Post: What macro economic indicators do you watch?

Post: What macro economic indicators do you watch?

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

What macro economic indicators do you watch?

Post: Paid Cash for all deals Good or Bad?

Post: Paid Cash for all deals Good or Bad?

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

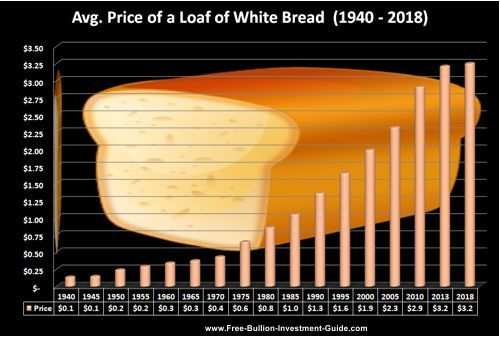

Low interest rate long term debt is preferred in this market due to the M2 money supply going up and the probability of inflation in some asset classes and deflation in others. In addition to inflation the velocity of money is and will continue to slow down which could put deflationary pressure on the dollar and certain asset classes.

When our currency devalues eventually due to money printing the banks/lenders will in effect be transferring wealth to you in regard to your financed properties.

Example

Today

A loaf of bread costs $2.50 and you have 100k left on a loan balance

So it takes 40,000 loaves of bread to pay off your note currently.

After inflation

A loaf of bread costs $10.00 and you have 100k left on a loan balance

So it takes 10,000 loaves of bread to pay off your note. Your 100k loan just isn't that much after adjusted for real inflation should this occur. Most economists I follow believe this is a likely scenario.

Inflation should generically reduce your comparative real debt along all asset classes.

Caveats:

1. Inflation/hyper inflation happens in asset classes that a majority of people use: food, fuel, durable goods, commodities

2. We are talking about debt here not values of homes. Those could be inflationary or deflationary in this environment depending on your location

3. Adjusted for inflation we could all be in a world of hurt across all asset classes depending on the severity in purchasing terms. That could be a good time to sell!

4. Inflation is underreported by the government so do more research to get better numbers. look up the website "shadow stats" for a more realistic number

5. 1 roll of TOILET PAPER could be worth an ounce of gold! (JK)

As always, this is just my opinion.

Danny

Post: Construction material delivery in Austin

Post: Construction material delivery in Austin

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

$75 delivery or less from HD

Post: Top 5 most expensive & inexpensive neighborhoods to rent in ATX

Post: Top 5 most expensive & inexpensive neighborhoods to rent in ATX

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

way too expensive for my taste

Post: Off market triplex. What’s my next step?

Post: Off market triplex. What’s my next step?

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

Can you qualify via credit/assets/income and just lack the 20% down? I would look for a partner. You also did not mention what LTV you are buying at. It could be a crap deal.

Post: Taking a big leap with real estate investing

Post: Taking a big leap with real estate investing

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

Find a mentor in an area you like, interview them and then decide if you want to move.

Post: Wholesalers in Austin or Bastrop

Post: Wholesalers in Austin or Bastrop

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

welcome

Post: 22 y/o new investor looking to buy first property

Post: 22 y/o new investor looking to buy first property

- Real Estate Broker / Investor

- Austin, TX

- Posts 834

- Votes 449

i would go conventional and look for programs with BPMI or LPMI to get rid of MI