All Forum Posts by: V.G Jason

V.G Jason has started 15 posts and replied 3397 times.

Post: Putting $1M into Crypto

Post: Putting $1M into Crypto

- Investor

- Posts 3,448

- Votes 3,528

If we see poor XMas and Black Friday sales, think we see that in Q4 earnings but that will be more Jan/Feb 2026.

Given how allocators have to allocate, if we see any positive momentum coming out of October into November, a lot of the folks will go sell their losers and drive up the winners to finish better on the year.

If Powell raises rates that would be incredible to see, and definitely possible, but would need more than just his vote on it. That's where it would be derailed and would turn political for the others.

Post: Comparing IRR of real estate vs. other investment types

Post: Comparing IRR of real estate vs. other investment types

- Investor

- Posts 3,448

- Votes 3,528

Quote from @Alan F.:

@V.G Jason @James Hamling

Your thoughts on interpretation of the Russell 2000, particularly in the overall health of small businesses present & future? Is sort of a canary in a coal mine?

Sort of the same question on the VIX? eager to learn more

TIA

The VIX is really a future-indicator look-- pricing in 30 day volatility really. North of 30 is really a fear signal, south of 20 is stability, and in between can be a trending indicator. This would be more of a canary in the coalmine of danger than anything else. It's the heartbeat and pulse in the forward view of the S&P.

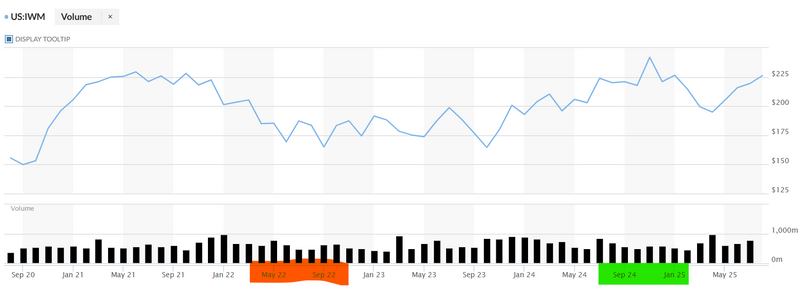

Russell 2000 is very functional off of the the dollar via the fed funds rate and overall treasury policies. You can literally see the demise of it as we entered rate ramping and the rally following rate cutting. A strong dollar can eat at a small business's ability to grow.

When the market is dovish and the pricing in a fed pivot it gets in front of the small cap play- the best two in my opinion are DFAT and AVUV. I do not like IWM, for what it's worth, I just use that as a metric or symbol of small caps. I would say it's more of a pulse of how interest rates impact growth; higher rates lead to lower growth. It's still "up" 7% over the past 3 years so the market has been able to withstand the headwinds some would say. Relative to other indices it's been stuck and low, so others would say it's an underperformer.

The canary in the coalmine, if any and unrelated to the VIX, would be the RSP(equal weight S&P) to actual S&P. Only very few times has the S&P actually outpaced the RSP, let alone by this margin. It just tells you concentration risk, and that is an evident issue but I don't know if it's a material risk. Nobody knows. My view on it is that's just the dollar devaluation syndrome after a strong dollar(esp. in 2022), and it'll be a consistent flight to quality unless we divest from a monopolistic tech society which I actually doubt. Think we see some new tech companies in the mega cap sector, but all the powers will be concentrated.

Lots of unknown events can derail the mega caps, I just don't know if dollars go to the equal weight. I would think if we see any defense played, it's sell NVIDIA or another mega cap and buy gold not necessarily ALGN(#300 in the S&P) or any stock in the back half of the S&P.

Post: Are Investors Backing Off, or Just Getting Pickier?

Post: Are Investors Backing Off, or Just Getting Pickier?

- Investor

- Posts 3,448

- Votes 3,528

It was a free for all for the seller's for about 2 years. Real estate agents kept the frenzy for another 1-2 years.

Now reality hits. At some point the fundamentals matter...and you're seeing that now.

Post: Comparing IRR of real estate vs. other investment types

Post: Comparing IRR of real estate vs. other investment types

- Investor

- Posts 3,448

- Votes 3,528

Quote from @Becca F.:

Quote from @V.G Jason:

Quote from @Becca F.:

Quote from @Bradley Buxton:

One advantage of real estate is that you can leverage the investment like a cash-out refinance. This is harder to put a price on, and it allows someone to continue to build wealth. An index fund and the like the money has to be put in up front, and to be able to "retire," either a person has to start early, have a high-earning job, or make some other large investment (inheritance). These are harder returns to measure. Overall, having some of both is likely the ideal scenario to maximize returns and tax benefits.

Absolutely agree with the leverage aspect of real estate. I did a cash out re-fi of the Indiana Class A home during COVID and took that money to help pay for renovations of my California property, increased the value of that home and it's all up to code and rented out.

One thing I've noticed is that non-RE people are very "pay off my mortgage on my primary" ASAP and at least the friends I've talked to aren't comfortable using leverage. They were horrified about me having multiple mortgages "all that debt" - for a RE investor I don't think I"m over leveraged and have significant equity, which is why I haven't bought anything in 2 years.

They equate mortgage debt on rental properties with consumer debt like credit cards and car loans, which is not in the same category. This is fine for them - I'm not going to change their mind. If they want to put 100% of the investments in S&P500, etc. and have a paid off house, it works for them.

If you really want to maximize all scenarios you leverage into everything at different amounts, and keep concentration RE wise which cash flow, have utility and excellent locations.

Leverage into index funds off of a general base, and take the net proceeds(after reserves & margin fees) and take them into gold & Bitcoin. And always keep enough cash for not just a rainy day, but also to exploit the fall.

Think how you would construct this backwards almost

vacation str lake tahoe(30% ltv)- net cash flow into gold & Bitcoin after reserves and margin. Can occupy as 2nd home

vacation str Sedona(30% ltv)- net cash flow into gold & Bitcoin after reserves & margin. Can occupy as 2nd home

2 ltrs of A quality in Phoenix or Vegas with 1.33 DSCR and pair with note for a % of the downpayment. net cash flow into gold and Bitcoin after reserves & margin.

every home is distressed and immediate value adds go in. Great edge on capital.

s&p 50% of your portfolio + 30% margin

avde 20% of your portfolio + 20% margin

avuv 10% of your portfolio + 20% margin

20% stocks of your portfolio to trade more spec with sub 10% margin.

Take profit every 15-36 months of index funds and equities & take proceeds into gold and Bitcoin.

I don't do this exactly, but the conceptual way is there. I play with more scale and way more color.

I'm starting to agree more and more with that sentiment that a lot of people including people posting on BP shouldn't do real estate. I've stopped telling my friends how great real estate. Just like I'm highly unlikely to buy crypto, RE isn't a good choice for some people. I'm looking at RE as part of my overall investment portfolio.

When I talk to people at meet ups, when a few of them told me about their portfolios my thought was "how are you making money?" The things they've done are similar to me with the Class C Indy home but buying 10 more Class Cs or worse Class D hoping it'll appreciate in the future but they're spending so much money in repairs and tenant issues. Makes no sense to me. Not to mention all the time those types of properties take.

A couple of experienced investors on BP said "You're not trying to be a property collector. You're trying to make money and build wealth." I think people get caught up in Person A has 50 units, Person B has 200 units, etc. I just read a recent post by a newbie saying they want to own X number of properties in 5 years.

I haven't heard of AVDE and AVUV, Avantis ETFs that are classified as small cap - will look into those. I started buying gold. I don't understand bitcoin so haven't bought any.

It takes me a day to read and digest all the comments, lots of great insights.

The crypto thread is a good study. Those Avantis ETFs one is international(avde) and the other is small caps(avuv).

Its something different than s&p(small cap) and the usa(int'l).

At this point RE is a wealth preservation not generator for the average folk. I don't see the barrier to entry resembling 2009-2016 or 2021-2022. Beyond utility, it's hard to make it work unless you really know how to underwrite and have the required patience.

Post: Putting $1M into Crypto

Post: Putting $1M into Crypto

- Investor

- Posts 3,448

- Votes 3,528

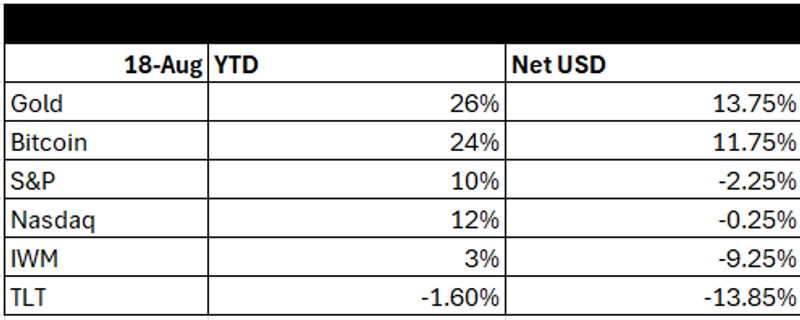

Like I said before, bitcoin, gold, and properly bought RE will be the best trades of this year.

Obviously, I do trade equities, but just from a sector standpoint those are the best trades.

The Dollar is down 9.55% and inflation is 2.7% this year. That's the net USD portion.

We're heading into fall with good ole uncertainty, q3 earnings will be the talk in a matter of 4 weeks, it would not surprise me to see Gold do a runaway victory. This Bitcoin YTD is as of today, so the $116k not $123k. I think that is indicative of some headwinds in the next 3-4 weeks in equities.

BTC/Gold is still in the 35x ratio, with the peaks being 40x from Dec 2024. Again, this is the proper way to measure it.

Important things to continue to watch are silver & copper.

Post: Rent Cheap to Invest More… or Buy Your Own Home Now?

Post: Rent Cheap to Invest More… or Buy Your Own Home Now?

- Investor

- Posts 3,448

- Votes 3,528

Buying a house now as a form of wealth generation not preservation will only fit in a minute amount of people's profile. It's only for people with significant income relative to rent or COL. If you're not in that; it does not make sense.

You're better off renting and investing the difference. Then once the investments compound, you can choose to divest it and buy a house with low to no debt, and the differential on rent/mortgage goes into other investments.

House hacking is a low hanging fruit. You're buying a resi piece and selling it with commercial valuations to another resi buyer. It's a bad net investment and you take a lot of liability managing it. Money is better almost anywhere else. Obviously, doesn't apply to every example, but most yes.

I swear the dogmatic approach of buying a house is always best, or even house hacking, will be the student loan story in 10-20 years.

Post: Does risking 90% to 100% of your investment with passive investing make sense?

Post: Does risking 90% to 100% of your investment with passive investing make sense?

- Investor

- Posts 3,448

- Votes 3,528

Quote from @Bryn Kaufman:

Quote from @Jules Aton:

I suspect we will see more of this in the near future. Despite how the pandemic era made it seem RE isn't easy or a sure thing.

"I suspect we will see more of this in the near future. Despite how the pandemic era made it seem RE isn't easy or a sure thing."

I would add "passive" in front of the RE. If you buy a property directly, the investment does not go to $0. Sure, you can lose money on it, but not 100%.

My points are all about passive RE investing, not active.

Passive is just that-- passive. You gave up all control. Couple it with the risk you can lose 100% and there you go.

I'll say it again, the most money is lost when overleveraged meets illiquidity. You dealt with the latter directly, and bought into the former without fully understanding.

Passive investing is a farce; you want to do strictly active investing and the way you make it somewhat not as "stressful" or "demanding" is defer the management but never ever the control. In this instance, you deferred the management but gave up complete control of your funds.

Post: Comparing IRR of real estate vs. other investment types

Post: Comparing IRR of real estate vs. other investment types

- Investor

- Posts 3,448

- Votes 3,528

Quote from @Becca F.:

Quote from @Bradley Buxton:

One advantage of real estate is that you can leverage the investment like a cash-out refinance. This is harder to put a price on, and it allows someone to continue to build wealth. An index fund and the like the money has to be put in up front, and to be able to "retire," either a person has to start early, have a high-earning job, or make some other large investment (inheritance). These are harder returns to measure. Overall, having some of both is likely the ideal scenario to maximize returns and tax benefits.

Absolutely agree with the leverage aspect of real estate. I did a cash out re-fi of the Indiana Class A home during COVID and took that money to help pay for renovations of my California property, increased the value of that home and it's all up to code and rented out.

One thing I've noticed is that non-RE people are very "pay off my mortgage on my primary" ASAP and at least the friends I've talked to aren't comfortable using leverage. They were horrified about me having multiple mortgages "all that debt" - for a RE investor I don't think I"m over leveraged and have significant equity, which is why I haven't bought anything in 2 years.

They equate mortgage debt on rental properties with consumer debt like credit cards and car loans, which is not in the same category. This is fine for them - I'm not going to change their mind. If they want to put 100% of the investments in S&P500, etc. and have a paid off house, it works for them.

If you really want to maximize all scenarios you leverage into everything at different amounts, and keep concentration RE wise which cash flow, have utility and excellent locations.

Leverage into index funds off of a general base, and take the net proceeds(after reserves & margin fees) and take them into gold & Bitcoin. And always keep enough cash for not just a rainy day, but also to exploit the fall.

Think how you would construct this backwards almost

vacation str lake tahoe(30% ltv)- net cash flow into gold & Bitcoin after reserves and margin. Can occupy as 2nd home

vacation str Sedona(30% ltv)- net cash flow into gold & Bitcoin after reserves & margin. Can occupy as 2nd home

2 ltrs of A quality in Phoenix or Vegas with 1.33 DSCR and pair with note for a % of the downpayment. net cash flow into gold and Bitcoin after reserves & margin.

every home is distressed and immediate value adds go in. Great edge on capital.

s&p 50% of your portfolio + 30% margin

avde 20% of your portfolio + 20% margin

avuv 10% of your portfolio + 20% margin

20% stocks of your portfolio to trade more spec with sub 10% margin.

Take profit every 15-36 months of index funds and equities & take proceeds into gold and Bitcoin.

I don't do this exactly, but the conceptual way is there. I play with more scale and way more color.

Post: I got robbed—and I didn’t even see it coming.

Post: I got robbed—and I didn’t even see it coming.

- Investor

- Posts 3,448

- Votes 3,528

These posts are just suspicious engagement one's with some AI backstory to help create the narrative.

If you have a designated PM team, you don't fish in another sea unless it's a completely one off or specialized issue. In those cases, they aren't done quickly.

Post: Rising Costs of Owning Real Estate – How Are You Adapting?

Post: Rising Costs of Owning Real Estate – How Are You Adapting?

- Investor

- Posts 3,448

- Votes 3,528

Quote from @Stuart Udis:

Over the past few years, the costs of owning and operating real estate have climbed faster than many of us expected. Stricter building codes, added environmental compliance, more expensive building materials and labor, the re-set on replacement costs continue to drive up insurance premiums are a few examples that come to mind and have impacted my business. For those of you actively investing or managing real estate, how are you dealing with these cost pressures? Are the costs influencing or changing your real estate investing strategy?

I've always underwritten for 7-9% increases. Doesn't happen linearly like that, but when it does I'm more than prepared.

Feel like most underwrite with no changes. I haven't seen that add selling pressure though.