All Forum Posts by: Don Konipol

Don Konipol has started 222 posts and replied 5506 times.

Post: Rate cap risk in a syndication deal

Post: Rate cap risk in a syndication deal

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Jason Piccolo:

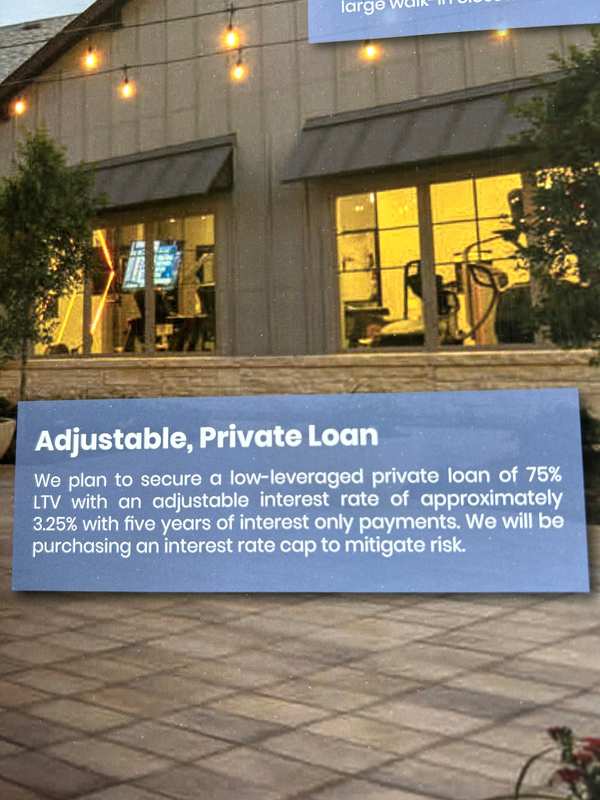

I just recently had all my equity wiped out in a passive investment multifamily deal with a reputable operator due to my ignorance of what a rate cap actually is. So to pay it forward I am letting the other passive investors know that when you see the General Partners are paying for a rate cap, inquire about the terms. I didn’t know that rate caps could be as short as 6 months. Granted the costs jumped in 2022 as well, but it can be misleading the way the marketing pieces are presented as you can see from the picture so ask questions.

This is why the passive investor needs to vet the sponsor, the property and THE DEAL. Any or all of these three can result in heavy losses. Remember, that in many syndications the investor is already starting with a 15 -20% “haircut as only 80 - 85%of invested capital is going into the property. The rest are fees, commission, etc. of one sort or another.

Post: Micro Car payment hack ?

Post: Micro Car payment hack ?

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Frank Shearer:

I was wondering if someone with more mathematical understanding has done a deep dive into paying off a car loan quicker by using multiple smaller payment like weekly or maybe 8 times per month micro payments. In Comparision to the standard " just 1 time" monthly Payment? If your loan allows for 4-8 partial micro payments going toward that monthly required amount it should add up by the end of the month to be 1 whole payment.

Example. I buy a used Honda civic 2021 for $21,000 with a 5% auto loan and 60 month term. The monthly payments would be 396.30 $ each month. So almost $ 400. What If I paid 99.40 $ every week and by the 4th week or the 28th of the month I would have paid $ 396.40 which would be the entire monthly amount and an overage of 10 cents. By paying 4 times I have multiple opportunities to reduce the overall daily amortization of the auto loan. So in the long run wouldn’t this allow for the pay off the car sooner than 60 months ? Ironically it’s essentially the same monthly amount I am paying but split up 4 ways to be paid weekly / every 7 days. Also could you take it a step further and do 8 total micro payments, so If the car payment is $400, the. It would be like $50 every couple days, but 8 total times a month. A lot of banks allow you to set up reoccurring electronic payments so you can just set up the rules! Essentially, it’s the same car payment each month, but I think with the micro payments, the car note will get paid off a lot sooner. Just not sure what calculator to use to show this or how to explain this to others. I think I there are still a lot of Financially focused people that still have car payments and this could be a super effective hack If it works and more ppl knew about it.

The end result of paying a 3 year amortized $20,000 loan at 5% interest with weekly payments vs monthly payments is a savings of $30.07, but only if the lender uses daily interest vs monthly. If the lender uses monthly then here is no savings.

If you were to pay daily your “savings” would be $57.44 over the 3 years

Of course these savings are an illusion, because you would not be earning interest on the payment amounts that are being paid prior to the due dates.

Post: The Stack Method

Post: The Stack Method

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Edward Johnson:

Hi Dan,

In our system whether or not a DSCR lender allows 2nd doesn't matter. We close the 2nd leg of the transaction with a real estate attorney. Has nothing to do with the lender

There are lots of people who have lost lots of money and ended lots more who ended up with criminal convictions for taking bad legal advice. Of course without knowing the specific situation it’s impossible to comment except in a general sense.

I’ve been a private/hard money lender a long time. I personally know 4 borrowers who served 4 years plus time for mortgage fraud. Closing “with a real estate attorney” is a necessity for almost all real estate transactions - it does not insure that the participants acted either legally or acted in compliance with contracts.

Post: 💸 The Overlooked Wealth Engine in STRs: Accelerated Principal Paydown + Appreciation

Post: 💸 The Overlooked Wealth Engine in STRs: Accelerated Principal Paydown + Appreciation

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @AJ Wong:

Quote from @Shannon Strickland:

Thank you, @AJ

What caught my attention was your mention of a 7% interest rate—something I understand. I recently started investing in real estate in my 50s with one coastal property and a high-interest 30-year fixed loan.

“Early” retirement is my goal, but instead of waiting for the elusive perfect market timing and getting stuck in analysis, I'm focused on what I can control:

* Outlasting others in my market who also bought at high rates. If I stay consistent and strategic, hopefully, time becomes my ally.

* In year three, projected cash flow will let me send extra toward the principal (not just CapEx & operations). That's when acceleration should begin. I need patience though.

* Right now, I’m laser-focused on being the best host I can be. I want guests to choose my place, not just for the amenities, but because the experience earns their trust—and their return stays help pay down my loan faster.

* Tip for youngsters: During deal analysis, run your numbers like pessimists do—low season, high expenses, delayed bookings. I was slightly too optimistic, and that doesn’t magically make cash flow appear.

I’m playing the long game, and I want to encourage other small-scale or new investors to think like operators—not speculators. Build resilience into your strategy early. Stay lean. High interest rates are challenging!

@AJ Wongundefined

Ditto. I made the 'mistake' of selling several prime properties over the years for what amounted to short term gains. Slow and steady wins the race!

There are other strategies/tactics/investment methods that can better satisfy investors operating under different motivations and desires. The only issue I have with the “this is nirvana” post and posters is that it portends that this is the best approach for EVERYONE - We have found TRUTH!. No, there’s a lot of shortcomings with this approach, and while it might be the single best, or at least an adequate approach for the risk averse, minimum involvement investor, it isn’t for others.

As I previously posted, the investor whose goals include a greater accumulation of wealth at a moderately greater risk would be better served by using excess cash flow to invest in ROI opportunities that pay a risk adjusted return in excess of the subject mortgage interest rate. And for active investors, the opportunities to reinvest that same cash flow at many times the ROI are available.

But this takes nothing away from your original post - its well thought out, clearly stated, and provides a great option for many investors.

Post: 💸 The Overlooked Wealth Engine in STRs: Accelerated Principal Paydown + Appreciation

Post: 💸 The Overlooked Wealth Engine in STRs: Accelerated Principal Paydown + Appreciation

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Gregory Schwartz:

I think the point you made about the risk adjusted nature of the paydown is the key point. Paying down debt is a 100% chance of that return. Meaning if your principal is lowered by 10% then there is a 100% chance you DONT have to pay that 5-8% interest on that 10% worth of principal.

Where else can you invest with 100% certainty that you will see a return?

@AJ Wong to your point, this is why I actually like my 20 year amortized loans. The principal payoff every month puts a smile on my face haha.

Post: My Second Wholesale Deal!

Post: My Second Wholesale Deal!

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Kyle Geoghagan:

Investment Info:

Single-family residence wholesale investment in Tallahassee.

Purchase price: $53,000

Sale price: $70,000

After graduating from FSU in 2022, I found my second deal using BatchLeads. A California investor had bought the property at a tax auction but couldn’t take on the rehab. We went under contract at $53,000. After failed buyers, I secured a family loan, closed, and became the owner. I sold it to a woman with a renovation loan and closed in November 2022.

What made you interested in investing in this type of deal?

It was all I knew how to do at the time. It was only my second deal and I did not really know anything about real estate. I am the kind of person to jump right into things and learn as I go.

How did you find this deal and how did you negotiate it?

I found it texting using BatchLeads. I negotiated over the phone, text, and email with the seller who lived in California.

How did you finance this deal?

It was originally supposed to be a wholesale deal where I never take ownership and only have my $100 EMD invested. Instead, I had to get a loan from a family member to purchase the property after my buyer flaked on me.

How did you add value to the deal?

First, I found the property which was going to rot away for the next few years while the guy from California worked on other projects. Secondly, I had to (literally) chop away literal trees in the driveway! That is how overgrown it had become. There way no way to bring a car into the property as there was no driveway! Surely just chopping some trees is not worth $12k. The real (and biggest) value I brought was connecting a seller in need with a willing flipper to bring life back to this property

What was the outcome?

The flipper got a cash flowing rental!

Lessons learned? Challenges?

Learn to do your numbers first. I almost got stuck with this thing because I knew nothing at the time and it was going to cost way more to fix up than I had initially anticipated.

Did you work with any real estate professionals (agents, lenders, etc.) that you'd recommend to others?

N/A

Post: 💸 The Overlooked Wealth Engine in STRs: Accelerated Principal Paydown + Appreciation

Post: 💸 The Overlooked Wealth Engine in STRs: Accelerated Principal Paydown + Appreciation

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @AJ Wong:

Everyone loves to break down STR cash flow, tax loopholes, and regulation nightmares (been there). But one piece that's way under-discussed is the quiet wealth you build just by letting your guests pay your mortgage for you — and how that stacks up with long-term coastal appreciation.

We're in contract on a riverfront cottage here on the Oregon Coast with the game plan to allocate all profit and excess revenue towards principal. If rates drop we're anticipating reducing the amortization to 15-20 years and intend to pay off the mortgage completely (early) and by 'retirement' age..free and clear - that's when the income will actually have a meaningful impact anyhow or we re-leverage to redevelop or sell to upgrade and/or re-invest.

The Wealth Engine Nobody Sees

When you run a short-term rental with a standard 30-year mortgage, every booking chips away at your loan principal. Early on, most of that payment is interest — but you’re still building equity every single month. Over time, that payoff snowballs.

Example:

- $700K loan at 7% interest, 30-year fixed

- Year 1: ~18% of each payment goes to principal

- Year 10: ~35%

- Year 20: ~60%

I like to call that forced savings guests pay for - it’s not sexy, but it quietly builds your net worth year after year.

Small Extra Payments = Huge Impact

A lot of people just pay the minimum mortgage and focus on cash flow. But an extra $200–$500 a month toward principal can slash your payoff timeline and total interest.

Example:

- Same $700K loan

- Toss in $500/month extra → loan paid off ~5 years sooner

- That’s tens of thousands in interest savings — or money you can roll into your next deal.

When Rates Drop, It Gets Even Better

Rates are high now. They won't stay high forever. If/when rates drop, STR owners have a triple win:

- Refi to lower payments → boost cash flow.

- Keep paying the same → pay it off faster.

- Cash-out refi → tap tax-free equity for your next coastal buy.

Same property, same guests — but you just unlocked another wealth lever while everyone else complains about rates.

Layer on Coastal Appreciation

Principal paydown is only half the play. The Oregon Coast (and similar under-the-radar coastal markets) have decades of tight supply, slow development, and steady demand.

Quick context:

- Oregon’s strict land use = very little new oceanfront supply.

- Small coastal towns cap STR permits — fewer competitors, steady demand.

- Historical average coastal appreciation: 4–6% per year, with some towns outperforming due to luxury golf, hidden beaches, and second-home momentum.

Second Homes + Climate Momentum

One thing I love about the Oregon Coast: buyers see it as legacy. Improving climate, no hurricanes, low wild fire risk and a place families return to year after year. That pushes long-term resale values and second-home demand.

Takeaway

Everyone talks cash flow, but don’t forget what happens while you sleep!

- Guests pay your principal.

- You can speed it up with tiny extra payments.

- You refi when rates drop.

- Coastal appreciation stacks on top.

This is how an STR quietly turns into a paid-off, $1–$1.5M coastal asset you own outright — while paying you to hold it.

So yeah..guests cover your loan, the coast covers your equity, and you enjoy a beach house your grandkids will brag about.

Who else is playing the long game?

Nothing wrong with that - and in fact there is some positive risk adjustment factors to lowering the LTV of any debt on your property. However, if you can invest that same money you use for the “pay down” at more than 5% (on a risk adjusted basis) you will be wealthier and have a higher accumulate net worth. As an example, I have in the past obtained mortgages from 2.75% interest to 4.5% interest. Rather than pay them down with positive cash flow, I invested the cash flow into real estate notes yielding 12 - 24%, and real estate providing an average annual return on my investment of 8 - 12%.

There are all sorts of ways to run the calculations, but mathematics is definitive, if the assumptions are correct. A rigorous analysis of paying off a loan with excess cash flow vs investing that cash at a much higher ROI than the interest rate of the subject loan will yield some surprising result, surprising by the magnitude of the advantage of reinvesting in higher ROI. In general, over 18 -20 years if success at reinvesting at say double the interest rate on the “pay down” the investor would have a net worth triple + than paying down the loan. Albeit at a somewhat increased level of risk, perhaps.

Post: Buy and Hold vs Profit Maximization

Post: Buy and Hold vs Profit Maximization

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Basit Siddiqi:

I think there is a sliding scale when it comes to investing / business.

If you are a 100% investor(in syndication or buying in A / B Class neighbhorhoods and using a PM Company), your returns will be on the lower end.

if you incorporate some 'business activity' to the investment(Self-managing rentals, STR, rental arbitrage, etc) you may get a higher return but at a cost of putting more time.

The question is is the added time worth the extra money you are getting?

For me, I beleive in making as much money from my business(Accounting professional) and funneling that money into Long-Term Real Estate and passing it off to a PM company.

I strive to make an 8% to 12% return which means my money should double about every 7 yerars.

Post: Hard Money Lending on Primary Residence

Post: Hard Money Lending on Primary Residence

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Joshua Talamante:

I know relatively little of the specifics of how the SAFE Act and the CFPB apply to residential home loans, mainly because I invest and lend commercial property almost exclusively. @Chris Seveney and @Jay Hinrichs can specific information, thoughts, and qualified opinions.

Post: LLC w/ Spouse vs Trust

Post: LLC w/ Spouse vs Trust

- Lender

- The Woodlands, TX

- Posts 6,279

- Votes 9,928

Quote from @Mitchell Zoll:

@Damon Kellar Agree with Don that you are overcomplicating it. I can't agree with the Series. That is just more complication. You don't get anything for it in a legal context, and the accounting becomes a nightmare. For estate planning purpose, it is smart to have a trust. Meet with a lawyer to discuss how to create the trust and how it operates. For the properties, you can own in the name of a trust, or own in an LLC that is owned by the Trust. But before you do a complicated web of holding and operating companies, read your state statutes and local ordinances. You might not be avoiding liability... and instead you are just creating more defendants. Read the local case law addressing who is liable for premises liability matters. Both in terms of LLCs (series or otherwise) and defendants.... more is not better.

We have used Series LLCs having graduated from LPs in our syndication business. I also utilize a Series LLCs for my personal investments. I’ve been very pleased with both. Am I missing something?