All Forum Posts by: Omar Khan

Omar Khan has started 11 posts and replied 1427 times.

Post: Running Multifamily Comps

Post: Running Multifamily Comps

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Patrick Winn:

What is the best way (websites, comps, calling other complexes in the area) to see if an area is a good area to invest in when looking at a small multi-family apartment complex, with a lower end cap rate, out of state?

I have been calling other complexes (as mentioned above) and simply asking them what their rent is as well as looking at "apartments for rent" on Google but if anyone knows of a platform that expedites this process, that would be very helpful!

Thank you in advance.

CoStar, Yardi, RealPage (which is HQ in DFW).

Literally, all the info you will ever need at your fingertips.

Post: Yield Curve Inversion, Buyers market around the corner?

Post: Yield Curve Inversion, Buyers market around the corner?

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Russell Brazil:

Everyone likes to think they are Nostradamus. Guess what, not a single one of us here are.

"Far more money has been lost by investors preparing for corrections than has been lost in corrections themselves."-Peter Lynch

lol - 100% agreed.

Love how everyone is an armchair economist now expounding on the yield curve when 2 month ago people couldn't spell the term out.

Post: KP / Sponsor / Loan guarantor - what's the standard fee?

Post: KP / Sponsor / Loan guarantor - what's the standard fee?

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Brian Burke:

Originally posted by @Yonah Weiss:

Great point, Yonah. I suppose if I did I could probably make a killing. Trouble is, I've spent 30 years building a reputation and there's too much risk in it for me. The market is uncertain, and some sponsors that don't have the strength to be their own KP/loan guarantor might be at a greater risk for their deal imploding when the weather gets stormy. That leaves me to patch it up, take over, contribute money, or any number of other unfavorable things. I could profit, sure, but from where I sit my downside is greater than my upside. I make my money doing real estate investments, and if someone else's deal jeopardized my ability to finance my own deals, I threw my whole career away just to make a few dollars. I'll pass!

Great point! No amount of money is worth the loss of hard won reputation.

Also, you probably know this better than most, but there is a big difference between the #s promised by newbie syndicators and actual performance (which is where the rubber meets the road).

Post: Question for syndicators

Post: Question for syndicators

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Charlotte Dunford:

1. From a tax perspective, is it more beneficial for LP's to pay them more often so that they can invest the received profits into other investments? What is a good frequency to pay your LP's?

2. What type of tax deductions can the LP’s take on their return on investment?

3. What type of tax deduction can a GP take on their income?

1) While it is better to have a more frequent distribution than a less frequent distribution, most people typically do quarterly because it is a nice middle ground between convenience and administrative hassle.

2) Cost segs are the big ones. I would also advise to look at your K1 to make sure that the sponsor isn't playing any games. Typically, some sponsors (mostly mentorship groups here in TX), will be deducting ALL of the returns they pay against your equity i.e. as time goes on you will have less and less of a share in the deal.

3) Typically, expenses associated with asset management (for which they may or may not get reimbursed), can share in the cost seg and also have more control over the timing and frequency of distributions to manage their tax position better (unlike LPs).

Don't know why most of the posts above you have asked you to consult with a CPA. Unless you have a very complex tax situation, 80%-90% of the deductions are the same, across the board for LPs and GPs.

Just remember as an LP you have less control, as a GP you have more control.

Post: What CAP rates are you seeing in your market for multifamily

Post: What CAP rates are you seeing in your market for multifamily

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Alejandro Hernandez:

@Omar Khan hey! I am seeing as high as 8% positive cashflow after all expenses including financing.

Big difference between cash flow and cap rates.

Post: First Post and Seeking a Very Specific Type of Book

Post: First Post and Seeking a Very Specific Type of Book

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Raphael Collazo:

Hey @Stephen!

I would recommend checking out "How to manage residential property for maximum cashflow and resale value" by John T. Reed. Although I have not read this book in particular, I have read several of John's books and they're absolutely phenomenal. He's extremely granular in his analysis and leaves no stone unturned. I've provided a link to the book below:

https://johntreed.com/collections/real-estate-investment/products/how-to-manage-residential-property-for-maximum-cash-flow-and-resale-value-7th-edition

Also, if you get a chance, I would recommend reading his book "Aggressive Tax Avoidance for Real Estate Investors". It's probably his most well known work and it's the best book I've read on real estate taxes. Hope this helps.

All the best,

I will second this recommendation. Most books are written from by marketers/"thought leaders" so they will not dig deep into asset management because it is not their forte. Any junior/senior from a top 100 college in accounting/finance should be able to give you 80%-90% of the same knowledge (without providing a pitch for their coaching/mentorship product).

That being said, typically you will need:

- Budgeting skills especially comparing against #s promised to investors vs. budget set with PM vs. actual operational results.

- Capex tracking by line item for exterior and interior.

- Marketing/leads tracker to understand weekly operations

- Rent comp surveys (your PM should be able to help you with this)

- Portfolio level (if applicable) software that allows you to roll up results by property type. E.g. iLevel (if running a fund), or the Yardi / ResMan platform (not very nice from an IR perspective, also minimal data analytics)

The above are just a few of the items you will need (and might be already using).

Your best bet is to create dynamic dashboards to combine all these items together in an easy to understand manner.

Post: Dave Ramsey Is Misleading The Public

Post: Dave Ramsey Is Misleading The Public

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @George Gammon:

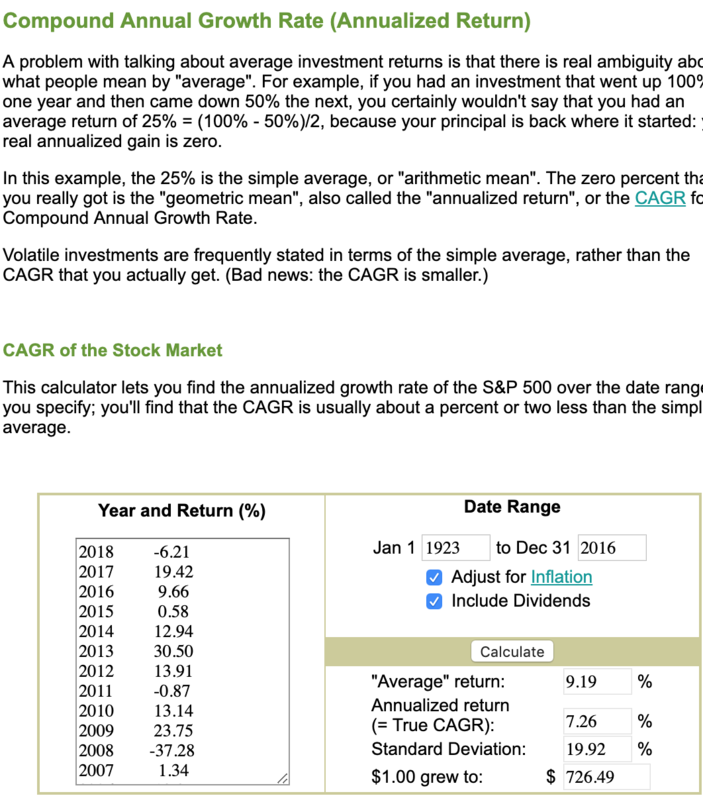

@Craig McLaughlin hey Craig thx for your reply. Just wanted to show you a calculator that actually calculates returns as defined by average Joes. In other words, how much money have I made or lost.

You can find it at moneychimp.com, (I'm in no way affiliated) I included the websites description because I think it does a better job than I did of explaining the average return fallacy. Hope that helps.

@Mike Dymski Hey Mike, yes looks like the returns as defined by normal people are around 7% 1923-2016. I agree with you mostly, but I just can't recommend index funds. P/E ratios are extremely high (see chart)

Interest rates have been in a 40 year bear market, which is highly cyclical. How do index funds perform if we go back to 18% rates in the next 40 years? And let's not forget the yield curve is inverted. My advice is to buy things when they're cheap and sell them when they're expensive. Nothing about any asset in the US is cheap except 30 year fixed rate debt (which I consider an asset)

As long as people understand the risk, but IMO they don't because they're sold index funds as low risk. The set it and forget it index fund has only worked because of a 40 year interest rate bull market and other market influences that most likely won't be there for the next 40 years. Look at the S&P returns 1923 - 1980 adjusted for inflation less dividends. Basically flat.

Hands down investing index funds and paying off those pesky credit cards would result in a better outcome for the vast majority of people as @Mike Dymski and @Jay Hinrichs have pointed out.

I do agree that the 12% calculation is completely made up but his advice on getting out of debt and on sound financial footing is solid. I don't believe in the "no debt ever" policy but do believe that a significant portion of the populace would be way better if they followed Dave's tough love advice.

Post: Should I wait to invest?

Post: Should I wait to invest?

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

@Jermaine Perry Just go on the Dave Ramsey diet. It's painful but you will get rid of your debt quickly. I don't necessarily buy into his "no debt ever" policy but I do believe that for the average person his tough love mentality is the way to go.

Post: What CAP rates are you seeing in your market for multifamily

Post: What CAP rates are you seeing in your market for multifamily

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Amber Saulsbury:

Hi there! I am looking at a 10 unit multifamily condo type complex. It's in a B class area. I am wondering what sort of CAP rates members are seeing for similar types of properties. I know this is very general information but just sort of wanting to see what other markets are averaging for this sort of property.

Thanks!

On value-add deals, the going in cap rate doesn't matter as much as the amount of upside (aka forced appreciation) potential.

You might find this article helpful: The Cap Rate Is Dead, Long Live the Cap Rate!

That being said, in TX and FL (major markets) for a B/C value-add property you're looking anywhere between 4.5%-6%.

Post: Underwriting Value - Market Rent or Contract Rent

Post: Underwriting Value - Market Rent or Contract Rent

- Rental Property Investor

- Dallas, TX

- Posts 1,473

- Votes 1,993

Originally posted by @Kyle Majors:

Thanks @Greg Dickerson. Here's a follow up for you. When I underwrite it based on the T-12 and those rents are higher than most of the comparable rents, then the true market value from the appraiser will be lower. For example, if the NOI in a 7 cap area is 200,000 its value that I derive from my underwriting would be 2.86 mil but compared to a 7 cap area where the appraiser drops the rents and now the NOI is around 175,000 then the value would be 2.5 mil. Where would you start the conversation with that broker.. the 2.86 or 2.5? My concern is that I don't want to overpay unless I have to be competitive of course.

Who cares about someone else's opinion? You have to go with your underwritten #s. That being said, you will realize that most gurus/coaches (at least the ones who are not doing active deals) provide amateur-hour advice when it comes to the actual negotiations around valuation.

Many times, the whisper price is just that - a whisper. The actual price can be significantly lower or higher than what the broker is guiding towards. This is where knowing the comps, the state of the market and the interest that the property is generating can really help.

We have been awarded deals where our price was significantly below the whisper price. In those cases, we either had some form of an edge - pre-existing relationship with the broker/seller, track record which provided surety of closing and/or more aggressive non-monetary terms (less days to close).