All Forum Posts by: Phillip Dwyer

Phillip Dwyer has started 93 posts and replied 1896 times.

Post: Corona Virus Impact to Las Vegas Market

Post: Corona Virus Impact to Las Vegas Market

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

@Casey Powers You're right. The article was from April not May, I don't know how I missed that. These last few months have been a blur.

Post: Corona Virus Impact to Las Vegas Market

Post: Corona Virus Impact to Las Vegas Market

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

Here's an article from the Review Journal that gives the actual statistics for unemployment: https://www.reviewjournal.com/...

Post: Corona Virus Impact to Las Vegas Market

Post: Corona Virus Impact to Las Vegas Market

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

@Guy Bouchard I believe those numbers include owners in forbearance.

Post: Corona Virus Impact to Las Vegas Market

Post: Corona Virus Impact to Las Vegas Market

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

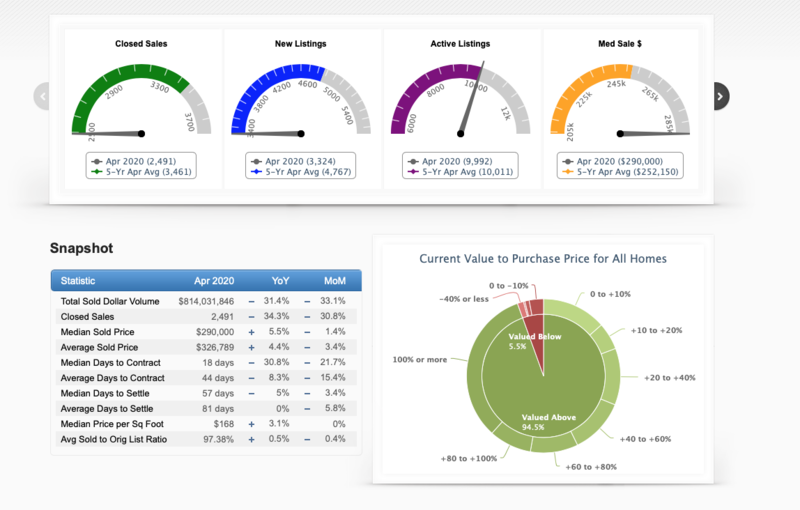

The photo is a screenshot from MarketTrends. This is for the entire Vegas metro. I find the pie chart in the lower right corner to be one of the more important things to consider right now. This chart shows the equity positions of property owners. Based on these stats, most owners are in a position to be able to sell and make substantial profit even if prices fall.

Post: Any one in Vegas actively trying to grow

Post: Any one in Vegas actively trying to grow

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

@Kevin Paglia if you're one of those with lots of extra time now, it's a great time to grow your knowledge base. Read as much as you can. Drive neighborhoods to get familiar with each one as you compare to the data. Research school districts. Find out where new developments are going to happen. The list goes on.

When people get scared, they often use that as an excuse to not take action. It can be difficult to not get sucked into that thinking. I'm mostly talking about real estate agent sales here, but it applies to just about everything.

I'm rebooting and working the plan I had at the beginning of the year. So far it's paying off well. It's a great time to gain market share and help consumers in need.

Post: Sell and 1031 exchange to a better market, or hold?

Post: Sell and 1031 exchange to a better market, or hold?

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

@Tracey Corea For deposit calculations, we typically go with what the market will bear. It's mostly been something similar to 1 month's rent. Legally we can charge more, but I don't think the market would support 3x rent unless you were lowering your credit or pet standards.

According to MLS rental stats for the past 7 days, 413 new rental listings hit the market and 432 listings were rented. I expect that trend may continue as would-be first-time buyers are having to stay renters or choose to put off their purchase.

Post: Sell and 1031 exchange to a better market, or hold?

Post: Sell and 1031 exchange to a better market, or hold?

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

@Tracey Corea This is a great post. It sounds like you've learned a ton from prior issues, and are able to apply that acquired knowledge to good use in decision making.

You mentioned 1031's being tricking. They can be. If you reverse the order in which you do the exchange, maybe it's not as tricky. I.E. Find the better alternative property, get it in escrow with a longer contract date and/or contingency to sell your current property. In this way, you can mitigate the 45 day identification risk. This is a great route, if you actually have way better alternative properties to purchase.

I'm most certainly not a mortgage rate expert, but from what I gather by talking to others is that rates aren't going up anytime soon. So you could put your refinance decision off until there are opportunities or you feel better about the decision. If property values go down, you wouldn't be able to borrow as much. However, I have a feeling you wouldn't have maxed out anyway given what you said about risk tolerance.

I guess you could pull money out now and just park it until opportunity arises. If there is no opportunity you could just pay off the note and pay the finance charges.

Like @Bill B. had mentioned, the rental market was slowed for a few weeks, but it seems to be heating up quickly. You may be able to get more rent than what you had been.

Post: Los Angeles vs. Orange County vs. Henderson??

Post: Los Angeles vs. Orange County vs. Henderson??

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

@Alex Stewart Henderson has a ton to offer. A few of financial perks over SoCal include no state income tax, lower property taxes, and lower cost houses. Much of the housing stock and city infrastructure for the price range you mention is much newer the SoCal too, so property taxes should be more stable and your maintenance costs of the homes should be lower too.

There are 139 houses from $1-4 mil on the market in Henderson now. That's about a 15 month supply. There's plenty to choose from. There are plenty of new construction possibilities as well.

A lot of buyers in the price point look have "views" as one of the primary drivers of the purchase decision. You can get homes with panoramic views of the Las Vegas Strip, golf and canyon fairways, and mountains. Many times you compromise some on walkability to get a view, but that's not a 100% of the time.

With the exception of maybe Lake Las Vegas (still in Henderson) you'll have relatively quick access to freeways, airport, the Vegas strip, and much more. The huge advantage here compared to SoCal, is the time you'll get back from not wasting time in your car. It sounds like you travel a lot, so a quick Uber or drive to the airport will likely give you much life back.

Post: So how's the Las Vegas Market?

Post: So how's the Las Vegas Market?

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549

Hi Brad. If you look at median sold price per square foot of resale sfr it actually has gone up for April compared to March.

Post: Corona Virus Impact to Las Vegas Market

Post: Corona Virus Impact to Las Vegas Market

- Real Estate Agent

- Henderson, NV

- Posts 1,970

- Votes 549